kupisotky.ru

Market

How To Read A Credit Report For Dummies

Visit Experian to read more and register. By signing up, you will receive a free credit report and FICO Score instantly. Option 3: Open a college student card. Lenders and creditors report account information, such as your payment history, credit inquiries and credit account balances, to the three main consumer credit. Below we've provided explanations of important sections of your credit report along with key things to look for and what impact the information in those. This document is provided only to assist new users in reading an Experian Credit Report. It is not intended to be authoritative, and may not reflect the. Bankruptcy Case Records & Credit Reporting · Bankruptcy Noticing · Unclaimed BAPCPA Report · Civil Justice Reform Act Report · Federal Court Management. D&B Failure Score – Predicts the likelihood that the company will seek legal relief from creditors in the next year or cease operations and leave creditors on. Compliance with the Fair Credit. Reporting Act (FCRA), the Equal Credit Opportunity. Act (ECOA) or their respective regulations is the responsibility of each. In Canada, there are two main credit reporting agencies: Equifax Canada and TransUnion Canada. These agencies sell credit reports to their members, which. Your credit reports include information about the types of credit accounts you've had, your payment history and other information such as your credit limits. Visit Experian to read more and register. By signing up, you will receive a free credit report and FICO Score instantly. Option 3: Open a college student card. Lenders and creditors report account information, such as your payment history, credit inquiries and credit account balances, to the three main consumer credit. Below we've provided explanations of important sections of your credit report along with key things to look for and what impact the information in those. This document is provided only to assist new users in reading an Experian Credit Report. It is not intended to be authoritative, and may not reflect the. Bankruptcy Case Records & Credit Reporting · Bankruptcy Noticing · Unclaimed BAPCPA Report · Civil Justice Reform Act Report · Federal Court Management. D&B Failure Score – Predicts the likelihood that the company will seek legal relief from creditors in the next year or cease operations and leave creditors on. Compliance with the Fair Credit. Reporting Act (FCRA), the Equal Credit Opportunity. Act (ECOA) or their respective regulations is the responsibility of each. In Canada, there are two main credit reporting agencies: Equifax Canada and TransUnion Canada. These agencies sell credit reports to their members, which. Your credit reports include information about the types of credit accounts you've had, your payment history and other information such as your credit limits.

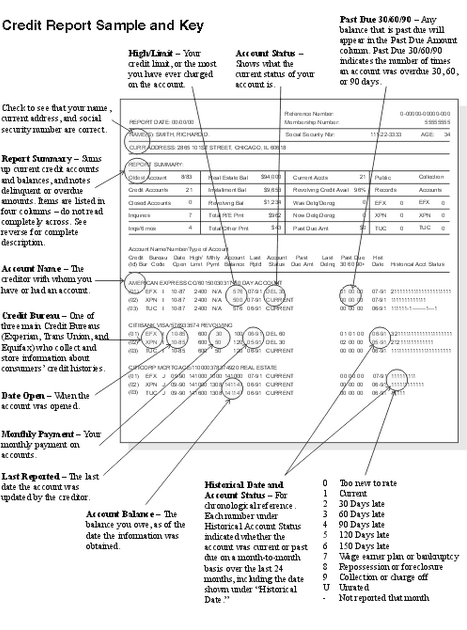

In Canada, there are two main credit reporting agencies: Equifax Canada and TransUnion Canada. These agencies sell credit reports to their members, which. Your credit score is a three-digit number between and that shows how well you've paid your bills in the past and the likelihood you will pay your bills. 2. Review your credit reports · Personal information, such as the name and address listed on your account · Account information, such as balances, credit limit. Individual debtors with primarily consumer debts have additional document filing requirements. They must file: a certificate of credit counseling and a copy of. What's in your credit report? · your name, address, and Social Security number · your credit cards · your loans · how much money you owe · if you pay your bills on. Credit Report · Credit Resources · debt · Debt Basics · Understanding Debt Load Understanding the wise use of credit is essential to achieving many financial. Credit Repair Kit For Dummies (For Dummies (Business & Personal Finance) Also included are sample credit reports, forms, templates, and other. You know your credit report is important, but the information that credit reporting companies use to create that report is just as important—and you have a. A: A credit report is a record of your credit history that includes information about: credit score, read the Federal Reserve's 5 Tips for Improving Your. Dispute inaccurate or missing information by contacting the credit reporting agency and your lender. Read more about disputing errors on your credit report. Sample credit report (print image format). From left to right, headers on the second row read as follows: • HIGH CRED: Highest amount ever owed on an. Your credit report will show each trade individually. Trades are loans, credit cards, etc. For loans and credit cards you'll see up to two years. Credit Repair Kit For Dummies gives you the tools you need to repair your credit. Online you'll find sample credit reports, forms, templates, and other. Hard inquiries on credit reports can impact credit scores, but soft inquiries do not. Do your credit homework before shopping for a loan. School report cards. Generally, credit reports are broken down into five main sections. Personal Information Your credit history is linked to your Social Security number. Your credit report contains important information about your credit history. Learn how to read yours. The national average FICO credit score was as of October VantageScore and also use the same to range as FICO, but scores are. The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus. Compliance with the Fair Credit. Reporting Act (FCRA), the Equal Credit Opportunity. Act (ECOA) or their respective regulations is the responsibility of each. Credit scores typically fall in one of the credit score ranges that determine if your credit is excellent, good, fair or poor. Learn how to take your score.