kupisotky.ru

Overview

Fired For Theft But Not Charged

Be charged with a felony, which can carry stiffer penalties, including higher fines and longer sentences. A criminal defense lawyer in your area who is familiar. Theft and embezzlement are serious charges, regardless of the circumstances. If fired as a result, you'll have a negative mark on your career and your. Lawyer here but not your lawyer. They probably won't do anything and will cool off and decide you getting fired was punishment enough. This may seem frustrating and unfair, but there isn't legal recourse unless it can be proven that the firing was due to a protected reason. Causes for an NC. The answer would be no. However, if you were applying to them or one of their related businesses, then yes, they it could appear. You can be fired for a number of reasons not outlined in your company handbook. Learn about the things that could get you fired beyond theft and lying. If you get caught stealing money from work you're going to have to deal with the consequences - and we're not just talking about getting fired. not charged to print the stub each pay period. Deductions from Wages for Loss, Theft, Damage, or Faulty Workmanship. Employers may only make deductions from. If you're caught stealing from work or breaking the law in some other way, the company you stole from could charge you with gross misconduct. Be charged with a felony, which can carry stiffer penalties, including higher fines and longer sentences. A criminal defense lawyer in your area who is familiar. Theft and embezzlement are serious charges, regardless of the circumstances. If fired as a result, you'll have a negative mark on your career and your. Lawyer here but not your lawyer. They probably won't do anything and will cool off and decide you getting fired was punishment enough. This may seem frustrating and unfair, but there isn't legal recourse unless it can be proven that the firing was due to a protected reason. Causes for an NC. The answer would be no. However, if you were applying to them or one of their related businesses, then yes, they it could appear. You can be fired for a number of reasons not outlined in your company handbook. Learn about the things that could get you fired beyond theft and lying. If you get caught stealing money from work you're going to have to deal with the consequences - and we're not just talking about getting fired. not charged to print the stub each pay period. Deductions from Wages for Loss, Theft, Damage, or Faulty Workmanship. Employers may only make deductions from. If you're caught stealing from work or breaking the law in some other way, the company you stole from could charge you with gross misconduct.

Job termination Workers' Rights File a complaint, Job termination Workers' Rights, File a complaint, My employer fired me for an unfair reason, or for no. stealing”). Because there is such a fine line between what is legal and Being fired from a job does not disqualify you from receiving unemployment. travel time during the work day (but not ordinary commuting time between home and work). Employers may not charge workers for paystubs. Paystubs may be. Furthermore, the employer is not legally required to provide you with an advanced notice of your termination. The only exception to these rules is a scenario. The short answer to your question is yes. If the company decides to press charges, they can do so unless you have a signed settlement agreement with them. Thus, the answer to your question is you might be arrested, but it works on the presumption that the company refers this to the police and depends on whether. Thus, if a defendant is charged in an Information with Employee Theft- $$, the allegation constitutes felony grand theft (third degree), based on the. not hovering around the document that is being prepared. If the employee refuses to admit theft even where there is indisputable evidence of guilt, you must. Disciplinary actions can vary depending on the crime allegedly committed and the type of work that you do. Some employers will take no action until the case is. but the District Attorney's office did not file charges until almost two years later. I hired Wallin & Klarich Past Client Yahoo. I was charged with Find out precisely what you are being accused of stealing. Determine whether or not you are being fired or if you are being charged with a crime. Will your. Sometimes employers simply don't pay workers their final wages when they are fired or voluntarily ended their employment. This is wage theft. Unauthorized. It is certainly not uncommon for people in this situation to make incriminating comments. Typically, the employee is fired from their position and told that. An employer must give a truthful reason why an employee was terminated, if requested in writing by the employee within 15 working-days of termination. The. You may qualify for unemployment benefits if you were fired through no fault of your own, such as not having the skills to do the job. You may not qualify if. Theft. An employee who is fired for stealing from the company or from coworkers will most likely be ineligible to receive unemployment benefits. Committing a. When the NLRB investigation finds sufficient evidence to support the charge, every effort is made to facilitate a settlement between the parties. If no. Companies sometimes fire employees with little or no notice. But can you sue a company for firing you without notice? Unfortunately, being fired without a. In some cases, the employer has the right to fire an employee over pending charges. However, this is not always the case. Laws Regarding the Treatment of. If your boss fires you because of false allegations against you, that is not one of the exceptions to at-will employment. In other words, firing you over lies.

Can You Contribute To A Rollover Ira

You can make contributions to a rollover IRA, up to IRA contribution limits. For tax year , individuals can contribute up to $6, (with an additional. An IRA rollover (also known as IRA transfer) is a way to take your previous (k) retirement account with you, but there are tax impacts to be aware of. If your employer sends you a rollover distribution check made payable to you, you can deposit it directly into your IRA. Be sure to write your Schwab IRA. If there are both pre-tax and post-tax contributions in your (k), you might need to open a Roth IRA too. Which IRA should you consider for your rollover? With Roth k however, there is no such limit. Why is this important? If you're not eligible to contribute to a Roth IRA, you could contribute to a tax-free. When you leave an employer, you typically have four options for what do with your savings from a qualified employer sponsored retirement plan (QRP) such as a. However, if you choose to contribute directly to the IRA after your rollover, you'll be subject to the eligibility requirements. When you roll over to an IRA, you can maintain the tax-deferred status of your retirement savings when you follow the IRA rules. You can also combine (k)s. You can roll Roth (k) contributions and earnings directly into a Roth IRA tax-free. · Any additional contributions and earnings can grow tax-free. · You are. You can make contributions to a rollover IRA, up to IRA contribution limits. For tax year , individuals can contribute up to $6, (with an additional. An IRA rollover (also known as IRA transfer) is a way to take your previous (k) retirement account with you, but there are tax impacts to be aware of. If your employer sends you a rollover distribution check made payable to you, you can deposit it directly into your IRA. Be sure to write your Schwab IRA. If there are both pre-tax and post-tax contributions in your (k), you might need to open a Roth IRA too. Which IRA should you consider for your rollover? With Roth k however, there is no such limit. Why is this important? If you're not eligible to contribute to a Roth IRA, you could contribute to a tax-free. When you leave an employer, you typically have four options for what do with your savings from a qualified employer sponsored retirement plan (QRP) such as a. However, if you choose to contribute directly to the IRA after your rollover, you'll be subject to the eligibility requirements. When you roll over to an IRA, you can maintain the tax-deferred status of your retirement savings when you follow the IRA rules. You can also combine (k)s. You can roll Roth (k) contributions and earnings directly into a Roth IRA tax-free. · Any additional contributions and earnings can grow tax-free. · You are.

Learn how to rollover an existing (k) retirement plan from a former employer to a rollover IRA plan and consolidate your money. A rollover might be a pre-retirement distribution you receive from a former employer's retirement plan, or it could be funds—partially or wholly—that you wish. You can continue contributing to your rollover IRA. But there are rules, says Sallie Mullins Thompson, principal and managing member at Sallie Mullins Thompson. You can contribute to a (k) and an IRA in the same year. However, depending on your adjusted gross income (AGI), IRA contributions may not be tax-deductible. Once I roll over my retirement plan assets into a Vanguard IRA, can I make additional contributions to my account? Yes, you can make contributions to your IRA. There are no limits to the amount of assets you can roll over from your (k), (b) or an existing retirement account, but additional contributions can be. A rollover IRA is a retirement account designed so you can move your former employer's qualified retirement plan, such as a (k) or (b), into an IRA. You can also roll over from another IRA. As you switch jobs or retire, an IRA rollover allows you to keep potential tax benefits and move funds to an account. You can continue contributing to your rollover IRA. But there are rules, says Sallie Mullins Thompson, principal and managing member at Sallie Mullins Thompson. Many people roll over their (k) savings when they change jobs or retire. However, numerous (k) plans allow employees to transfer funds to an IRA while. Can you contribute to a rollover IRA? Yes, you can contribute to a rollover IRA. The contribution limit for is $7, ($8, if you're aged 50 or older). If you roll your (k) money into an IRA, you'll avoid immediate taxes and your retirement savings will continue to grow tax-deferred. An IRA can also offer. The simple answer is yes, you can. However, there are some caveats when it comes to deducting your IRA contributions if you participate in both types of plans. An IRA rollover (also known as IRA transfer) is a way to take your previous (k) retirement account with you, but there are tax impacts to be aware of. There are no limits to the amount of assets you can roll over from your (k), (b) or an existing retirement account, but additional contributions can be. So on the surface, it would appear you're good to go. However, although there are no income limits for contributing to a Roth (k), there are. In one of the articles I've read in the finance strategists website, yes, there's no legal restriction against holding both concurrently, but be. You can roll over lump sum payments representing your retirement contributions, including voluntary contributions, and applicable interest. Keep contributing. You can make contributions to a rollover IRA. However, income limits may apply for Roth IRAs. The maximum amount is $7, for If you'. Most plans qualify. You can do a tax-free direct rollover from most employer-sponsored plans including k, b, plans, and SEP IRAs. While rolling over.

Stocks Doubled In Last 3 Months

Stocks Trending up for last three Month period in Indian Stock Market ; Optiemus Infracom Ltd. OPTIEMUS, FINANCE ; Continental Seeds And Chemicals Ltd. CONTI. He may well have been up on the market most of the time until the last years of blowout toppiness in which the market doubled. 1 day: 52% 3 months. stocks doubled in last 6 month deep dive ; 1. Diamond Power, ; 2. Sri Adhik. Bros. ; 3. Tinna Trade, ; 4. Blue Cloud Soft. NIFTY BANK. 51, (+%). NIFTY Midcap 60, (+%). 1; 2; 3; 4. Quick View. Stock in News; Stock Last Visited; Watchlist. S A Tech Software India Ltd. SATECH, COMPUTERS - SOFTWARE ; Ndr Auto Components Ltd. NDRAUTO, AUTOMOBILES - 2 AND 3 WHEELERS ; Ravindra Energy Ltd. RELTD. Held on the 2nd OR 3rd Sunday of every month, across top cities in India. Invest Now 3; 4. Quick View. Stock in News; Stock Last Visited; Watchlist; Portfolio. Top Gainers: Top gainers in trading for 3-month in BSE ; Suven Pharmaceutical.. , (%) ; Suzlon Energy Ltd. , (%) ; India Cements Ltd. So, this penny stock almost doubled shareholders' money in recently ended month. 3] RLF: Share price of RLF Ltd has been in continuous bull trend for last one. Highest Return in 3 Months ; 1. Sri Adhik. Bros. , ; 2. Pondy Oxides, , , Stocks Trending up for last three Month period in Indian Stock Market ; Optiemus Infracom Ltd. OPTIEMUS, FINANCE ; Continental Seeds And Chemicals Ltd. CONTI. He may well have been up on the market most of the time until the last years of blowout toppiness in which the market doubled. 1 day: 52% 3 months. stocks doubled in last 6 month deep dive ; 1. Diamond Power, ; 2. Sri Adhik. Bros. ; 3. Tinna Trade, ; 4. Blue Cloud Soft. NIFTY BANK. 51, (+%). NIFTY Midcap 60, (+%). 1; 2; 3; 4. Quick View. Stock in News; Stock Last Visited; Watchlist. S A Tech Software India Ltd. SATECH, COMPUTERS - SOFTWARE ; Ndr Auto Components Ltd. NDRAUTO, AUTOMOBILES - 2 AND 3 WHEELERS ; Ravindra Energy Ltd. RELTD. Held on the 2nd OR 3rd Sunday of every month, across top cities in India. Invest Now 3; 4. Quick View. Stock in News; Stock Last Visited; Watchlist; Portfolio. Top Gainers: Top gainers in trading for 3-month in BSE ; Suven Pharmaceutical.. , (%) ; Suzlon Energy Ltd. , (%) ; India Cements Ltd. So, this penny stock almost doubled shareholders' money in recently ended month. 3] RLF: Share price of RLF Ltd has been in continuous bull trend for last one. Highest Return in 3 Months ; 1. Sri Adhik. Bros. , ; 2. Pondy Oxides, , ,

% returns, money doubled in 3 months - Penny stock to declare 1st-ever DIVIDEND, record date - Do you own? June 3, PM PDTUpdated 3 months ago GameStop raised $ million by selling shares to cash in on a meme stock rally last month, when the stock. May 24, AM PDTUpdated 4 months ago. A Nvidia logo is seen on The stock was last trading at around $1, Advertisement · Scroll to continue. Stocks in uptrend which made a new 3-year high today. ; Sanofi Consumer Healthcare India Ltd. year high ; ; ; 11, ; %. Stocks doubled in 3 months ; 3, Refex Industries Limited · REFEX ; 4, Balu Forge Industries Ltd · BALUFORGE ; 5, Power & Instrumentation (Gujarat) Ltd · PIGL ; 6. 3% this week, driven by higher demand forecasts and reduced output due to the past two months. Estimates indicate a nearly 50% production cut. 6 of the Most Shocking Stock Increases and Falls · 1. Winner: Volkswagen · 2. Winner: Gateway Industries · 3. Loser: Meta Platforms · 4. Winner: Amazon · 5. Loser. It's at $18 right now—the stock doubled in price in the last years and pays a steady % dividends. Another one is ABR which is only about. Interactive chart illustrating the performance of the Dow Jones Industrial Average (DJIA) market index over the last ten years. Each point of the stock. Sept. 3, , at p.m. As a result, the stock started off up nearly % and is now up %. Best Stocks of the Past 30 Years. The flagship cryptocurrency is on pace to end the month down 15% and post its first negative month in the past eight. Shares have more than doubled since the. If true, this would mean that they are nearly doubling their revenues in 5 years which is almost 14% revenue growth annually. In last years, revenues have. Month Gainers ; 1, TIL, Instil Bio, Inc. %, ; 2, DSY, Big Tree Cloud Holdings Limited, %, From Last. 5-Day, 4 times, +%. 1-Month, 1 time, +%. 3-Month, 6 times, +%. 6-Month, 5 times, +%. YTD, 1 time, +%. Week, 6 times, +. Cheap brokers and apps have made it much easier to invest in shares, and these have lead to a big rise in retail investors. Low bond yields have. Compared to the same period last year, the growth rate was a staggering stock picks each month. The Stock Advisor service has more than quadrupled. Working natural gas stocks totaled 3, Bcf, which is Bcf (10%) more than the five-year average and Bcf (6%) more than last year at this time. Which are the 5 stocks doubled in the last 9 months? 3, Views ; If one had to buy 3 stocks for the next 10 years, what would those be? 3) Indian Real Estate has doubled. 4) US Stock Market has doubled 7) Small cap has given close to % returns in the last 15 months.

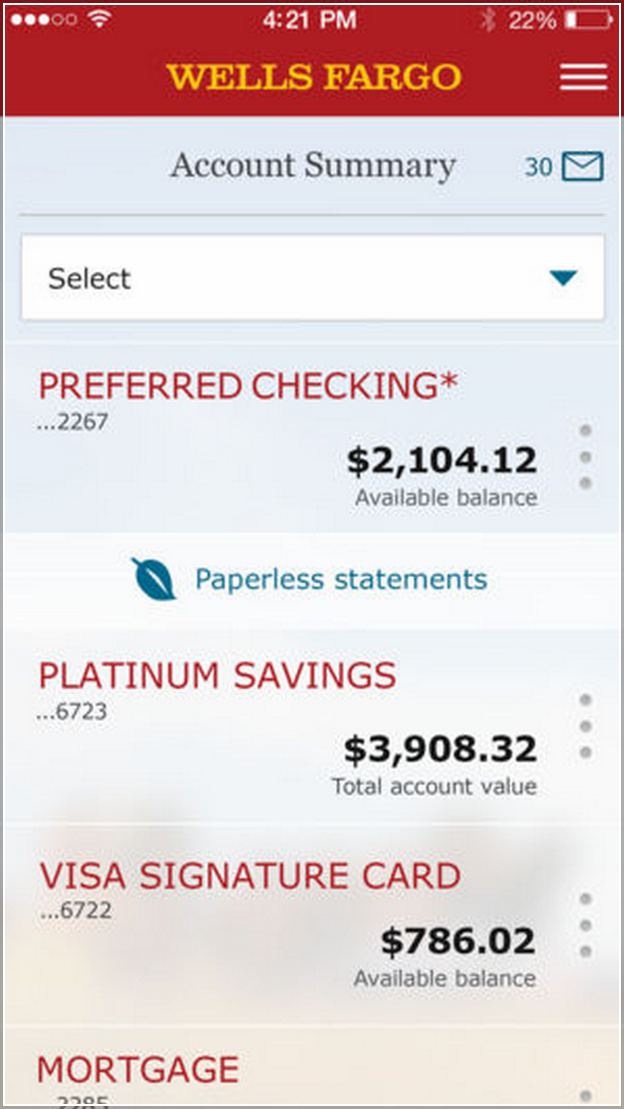

Wells Fargo Bank How Much To Open An Account

Avoid the $12 monthly service fee with a $3, minimum daily balance each fee period. $25 minimum opening deposit. Open now. Platinum Savings. Relationship. Both Wells Fargo savings accounts offer their standard APYs without conditions; you just need at least $25 to open the account. On the Way2Save Savings account. Compare our savings account rates to find the best savings account or CD account to reach your future savings goals. 6 months is a good rule of thumb, but varies. Also, some banks aren't overly strict about it. While it's open, be aware of any minimum balance /. Requirements: $, minimum opening deposit. $10, minimum subsequent deposits. For existing brokerage clients, at least 50% of the opening deposit and. Wells Fargo [Bank and Wells Fargo Advisors] discounts and benefits are available to all customers who have a Wells Fargo Premier Checking account. The Premier. The overdraft fee for Wells Fargo Teen CheckingSM accounts is $15 per item and we will charge no more than two fees per business day. Wells Fargo offers new customers $ for opening a personal checking account. Learn more about the Wells Fargo new account bonus promotions. It doesn't cost any at Wells Fargo to open a savings account or checking account. Usually $50 is minimum to open. The banks charge an. Avoid the $12 monthly service fee with a $3, minimum daily balance each fee period. $25 minimum opening deposit. Open now. Platinum Savings. Relationship. Both Wells Fargo savings accounts offer their standard APYs without conditions; you just need at least $25 to open the account. On the Way2Save Savings account. Compare our savings account rates to find the best savings account or CD account to reach your future savings goals. 6 months is a good rule of thumb, but varies. Also, some banks aren't overly strict about it. While it's open, be aware of any minimum balance /. Requirements: $, minimum opening deposit. $10, minimum subsequent deposits. For existing brokerage clients, at least 50% of the opening deposit and. Wells Fargo [Bank and Wells Fargo Advisors] discounts and benefits are available to all customers who have a Wells Fargo Premier Checking account. The Premier. The overdraft fee for Wells Fargo Teen CheckingSM accounts is $15 per item and we will charge no more than two fees per business day. Wells Fargo offers new customers $ for opening a personal checking account. Learn more about the Wells Fargo new account bonus promotions. It doesn't cost any at Wells Fargo to open a savings account or checking account. Usually $50 is minimum to open. The banks charge an.

What is the minimum opening deposit for business accounts? The bank has four checking accounts, and according to Wells Fargo, the Everyday Checking account is its most popular. The account requires a $25 minimum opening. Fee: $10 per month ; APY: N/A ; Minimum deposit to open: $ Fees may be charged by third parties or other banks, in addition to those described above. 2. Whether or not the wire transfer fee is waived, Wells Fargo makes. You'll only need $25 to open a Wells Fargo Prime checking account, but you'll need at least a $20, total balance in qualifying accounts at Wells Fargo to. Two forms of identification (ID) are needed to open at a branch · State-issued or U.S territory driver's license · State-issued or U.S territory ID card · Passport. Note that both accounts require a $25 minimum opening deposit. Account, Monthly Service Fee. Way2Save Savings, $5. Platinum Savings, $ Wells Fargo makes it fast and easy to open a bank account online. Gather the required personal information and the $25 opening deposit. Fees on checking accounts can easily be avoided. · Wells Fargo has eliminated non-sufficient funds (NSF) fees. · Wells Fargo offers early direct deposit. The monthly service fee for your Everyday Checking account will decrease to $10 and you'll have some new ways to avoid it, such as a decreased minimum daily. Minimum opening deposit is $ The monthly service fee can be avoided with one of the following each fee period: Primary account owner is 13 through 24 years. $ minimum daily balance; 1 automatic transfer each fee period of $25 or more from a linked Wells Fargo checking account; 1 automatic transfer. Open a new checking account with a minimum $25 deposit. The offer page specifies that you'll need to open an Everyday Checking account for this offer. You can open a Wells Fargo online checking account here. You'll need your Social Security Number, a valid ID and a $25 opening deposit that you can easily. Whichever checking or savings account you choose, you'll need a $25 opening deposit and, if you want to avoid monthly fees, you'll need to jump through at least. What is the minimum opening deposit for business accounts? This document helps you understand your account features and requirements, the fees that may apply, and how to minimize or avoid fees where possible. If you don. Explore convenient and secure ways to open checking, savings, and CD accounts, or apply for loans and credit online. Individuals. BankingCollapse. Skip Table. Open a new checking account with a minimum $25 deposit. The offer page specifies that you'll need to open an Everyday Checking account for this offer. Wells Fargo rates and products ; Checking accounts, 0%–% APY ; Wells Fargo checking account features. Minimum opening deposit, $25 ; Wells Fargo savings.

Selling Your Home On Your Own

How to Sell Your Home Without an Agent · 1. Evaluate the current market · 2. Choose your list price · 3. Prepare and stage your house · 4. Take listing photos · 5. Pros and Cons of Selling Your Own Property in Toronto · Possible Cost Savings · More Control Over the Process · Interact with Buyers Directly · Select the. The potential benefits include: · Cost savings. Selling your home privately means you are saving the commission you would ordinarily pay to a realtor. Opendoor is the new way to sell your home. Skip the hassle of listing, showings and months of stress, and close on your own timeline. In This Article: · Will you sell by owner or use an agent? · Learn the market. · Prepare your property to sell. · Price your home to sell. · Create a listing. Get all the benefits of selling on your own with a team of experts at your side. And if you already found a buyer and don't need to list your home, we can help. Avoid These Mistakes When Selling Your Home · Getting Emotional · Not Hiring a Real Estate Agent · Setting an Unrealistic Price · Expecting the Asking Price. The standard commission for selling a house with a real estate agent is 5%, 6% or even 7% in some real estate markets. As you might guess, that adds up to a big. Call an agent to assess the home's value, do your own research anlbout the market in your area. Agents aren't magicians and in my opinion. How to Sell Your Home Without an Agent · 1. Evaluate the current market · 2. Choose your list price · 3. Prepare and stage your house · 4. Take listing photos · 5. Pros and Cons of Selling Your Own Property in Toronto · Possible Cost Savings · More Control Over the Process · Interact with Buyers Directly · Select the. The potential benefits include: · Cost savings. Selling your home privately means you are saving the commission you would ordinarily pay to a realtor. Opendoor is the new way to sell your home. Skip the hassle of listing, showings and months of stress, and close on your own timeline. In This Article: · Will you sell by owner or use an agent? · Learn the market. · Prepare your property to sell. · Price your home to sell. · Create a listing. Get all the benefits of selling on your own with a team of experts at your side. And if you already found a buyer and don't need to list your home, we can help. Avoid These Mistakes When Selling Your Home · Getting Emotional · Not Hiring a Real Estate Agent · Setting an Unrealistic Price · Expecting the Asking Price. The standard commission for selling a house with a real estate agent is 5%, 6% or even 7% in some real estate markets. As you might guess, that adds up to a big. Call an agent to assess the home's value, do your own research anlbout the market in your area. Agents aren't magicians and in my opinion.

Selling your house on your own is time consuming and potentially stressful. You will have to place ads on your own, schedule tours, personally negotiate, and. Selling your home through a realtor has its perks, but it comes with hefty listing agent commissions and fees in addition to the buyer's agent commissions. Learn how to sell a house by owner in New York in Selling FSBO can save you money on listing fees, but doing everything yourself has risks. Browse exclusive homes for sale by owner or sell your home FSBO. kupisotky.ru helps you sell your home fast and save money. Technically you could save more money selling the house on your own. My realtor has saved me more headache and money through the process of. Listing the property for sale (usually on the Multiple Listing Services, or MLS, for maximum exposure in your market). · Hiring a real estate agent and paying. We buy all types of houses across the country. A Realtor will make you sign a contract just to list your house on your local MLS and hope for a buyer to come. Sell your home on your own. Manage your home sale and save on commission fees by listing For Sale By Owner (FSBO). Why sell FSBO. The final legal document you will sign to sell your home in Michigan is the deed. The deed serves to transfer the property from the seller to the buyer. The. While paying a portion of your home's sale to a Realtor may sound undesirable, there are many reasons why selling your house without one is. Only real risk is that people don't know how nor enjoy negotiating for themselves so you end up just stuck because you don't know all of their. Avoid These Mistakes When Selling Your Home · Getting Emotional · Not Hiring a Real Estate Agent · Setting an Unrealistic Price · Expecting the Asking Price. If you have time on your hands to show your home, advertise it, and negotiate with potential buyers, you might be able to sell your home on your own. If you're. The only way to sell your house online for free (without paying any kind of commission or marketing fees) is to find a buyer who isn't working with an agent. Learn how to sell your home using agent pairing technology that connects you with agents in real-time. It often makes sense to sell your current home before buying your next home. Most homeowners need the equity from their current home to make a down payment. Pick a selling strategy. Hire an experienced real estate agent. Clean everything. Depersonalize your home. Let the light in. Remove excess furniture and clutter. If you have the time and expertise to market the property and handle the paperwork, then selling on your own may be a good option. If you don't have the time or. However, listing your house as “for sale by owner” (FSBO) means you won't need to pay extra commission to a real estate agent — 6% of the selling price is. Should I avoid all Realtors when I sell my home For Sale By Owner in Brooklyn? Absolutely not. This is an extremely foolish idea if you wish.

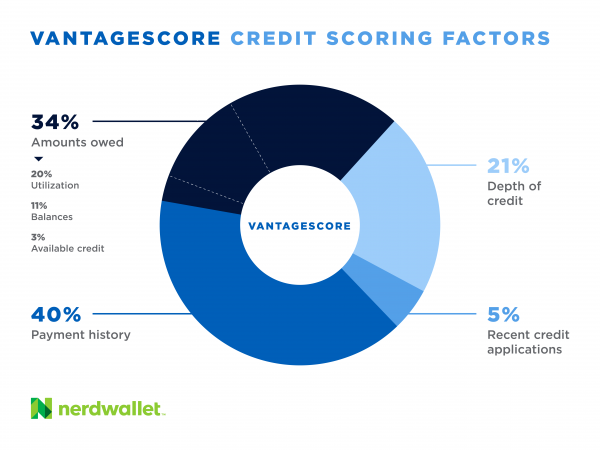

Why Is My Score Different On Credit Karma

#2 Credit Karma only reflects your scores from TransUnion and Equifax. When you have a major purchase like a home or car in your 3 to 6-month goals it's best to. There are a variety of scoring models that may cause variation in your score. For example, both Mint and Credit Karma use the VantageScore model. The FICO. Credit Karma is different from Experian. While Experian compiles your credit report and determines your credit score, Credit Karma simply shows you credit. Your FICO Score may differ from your VantageScores because of those different calculation methods. When working on building your credit, it's helpful to bear in. Credit Karma updates your credit scores on a weekly basis. However, please bear in mind that not all of your creditors report to the credit bureaus at the same. However, they all use similar ways of determining your FICO score, most of which depend on your credit utilization and payment history. If you have late. If your Credit karma reported scores are higher it's because your credit reports do better on the scoring system they're using than another. Why is my Members 1st FICO® Score different from Credit Karma? Credit Karma and other credit score reporting tools may use an Educational Score, which is. It's totally normal for your different credit scores to not be the exact same number at any given time. Lenders typically understand why your credit scores can. #2 Credit Karma only reflects your scores from TransUnion and Equifax. When you have a major purchase like a home or car in your 3 to 6-month goals it's best to. There are a variety of scoring models that may cause variation in your score. For example, both Mint and Credit Karma use the VantageScore model. The FICO. Credit Karma is different from Experian. While Experian compiles your credit report and determines your credit score, Credit Karma simply shows you credit. Your FICO Score may differ from your VantageScores because of those different calculation methods. When working on building your credit, it's helpful to bear in. Credit Karma updates your credit scores on a weekly basis. However, please bear in mind that not all of your creditors report to the credit bureaus at the same. However, they all use similar ways of determining your FICO score, most of which depend on your credit utilization and payment history. If you have late. If your Credit karma reported scores are higher it's because your credit reports do better on the scoring system they're using than another. Why is my Members 1st FICO® Score different from Credit Karma? Credit Karma and other credit score reporting tools may use an Educational Score, which is. It's totally normal for your different credit scores to not be the exact same number at any given time. Lenders typically understand why your credit scores can.

Each bureau gathers information on your credit accounts used in their systems independently and none of the three major bureaus share information with the. Is Experian the Most Accurate Credit Score? Credit scores from the three main bureaus (Experian, Equifax, and TransUnion) are considered accurate. The. You're likely to get different numbers when it comes to your VantageScore versus your FICO score because the algorithms used by each credit scoring model. When mortgage lenders review your credit history, it's likely they'll use a credit score formula tailored to determine what kind of risk you'll be for a. So, it's possible that Equifax and TransUnion could have different credit information on your reports, which could lead to your TransUnion score. Your FICO Score may differ from your VantageScores because of those different calculation methods. When working on building your credit, it's helpful to bear in. Credit Karma uses the VantageScore model to provide your credit score. While VantageScore and FICO Score both pull data from the same credit reports, they weigh. How do other lenders calculate my score? Most financial institutions use a FICO scoring model to measure consumers' credit scores. As mentioned, this number. We use the FICO 98 model to calculate your credit score when you apply for a large loan. While this number will likely differ from your Credit Karma score. Lenders may report updates to the credit bureaus at different times. If one credit bureau has information that's more current than another, your scores might. Your Credit Karma score is generated with the VantageScore credit scoring model, which weighs information in your credit report slightly differently than the. The credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit. Your credit score may also fluctuate when you check different credit score services that work with different credit bureaus. As stated above, the credit. #2 Credit Karma only reflects your scores from TransUnion and Equifax. When you have a major purchase like a home or car in your 3 to 6-month goals it's best to. Most financial institutions use a FICO scoring model to measure consumers' credit scores. As mentioned, this number will likely be lower than the score you see. Credit Karma's reports and scores are not the same with Equifax's as both have its own system of calculating scores. Since most banks will refer to your FICO. We believe it is important to have a good grasp of what your credit score is with both credit bureaus as different financial institutions will pull from Equifax. Depending on the scoring model and specific type of score used by another platform or lender, your score may look different. You can read more about the FICO. credit to get approved for a mortgage loan. If you want to get serious about your credit score and need some guidance, credit karma is your friend! more.

What Is Vantagescore Used For

Nope, most don't but there are those that do. Randolph Brooks federal credit union uses Vantage except for Mortgages BBT used vantage on me. Most influential: Payment history · Highly influential: Age and type of credit, percent of credit limit used · Moderately influential: Total balances and debt. VantageScore models open credit access to approximately 96% of adults in the U.S., empowering lenders to make confident decisions. The VantageScore model looks at familiar data — things like paying on time, keeping credit card balances low, avoiding new credit obligations, bank accounts and. VantageScores employs a proprietary scoring system that considers various credit-related factors such as payment history, credit utilization, duration of credit. Fannie Mae tests and validates required credit score models for accuracy, reliability, and integrity. FHFA announces publication of VantageScore historical. Developed with data from all three credit reporting companies, VantageScore® delivers unparalleled consistent performance across consumer credit products. VantageScore is a credit rating service that caters directly to individual consumers. · The scores generated by VantageScore fall between and . VantageScore is a leading credit-score model development company that generates the most inclusive, innovative and predictive models used in the consumer-credit. Nope, most don't but there are those that do. Randolph Brooks federal credit union uses Vantage except for Mortgages BBT used vantage on me. Most influential: Payment history · Highly influential: Age and type of credit, percent of credit limit used · Moderately influential: Total balances and debt. VantageScore models open credit access to approximately 96% of adults in the U.S., empowering lenders to make confident decisions. The VantageScore model looks at familiar data — things like paying on time, keeping credit card balances low, avoiding new credit obligations, bank accounts and. VantageScores employs a proprietary scoring system that considers various credit-related factors such as payment history, credit utilization, duration of credit. Fannie Mae tests and validates required credit score models for accuracy, reliability, and integrity. FHFA announces publication of VantageScore historical. Developed with data from all three credit reporting companies, VantageScore® delivers unparalleled consistent performance across consumer credit products. VantageScore is a credit rating service that caters directly to individual consumers. · The scores generated by VantageScore fall between and . VantageScore is a leading credit-score model development company that generates the most inclusive, innovative and predictive models used in the consumer-credit.

Who uses VantageScore? Financial institutions, like banks and credit unions, often pull your VantageScore to assess the risk in lending to you. Credit card. Eight of the top 10 banks, and 30 of the top 50 banks use VantageScore credit scores. Usage of VantageScore is widespread across loan types however the top VantageScore , with scores ranging from to , is a user-friendly credit score model developed by the three major nationwide credit reporting agencies. Mortgage lenders are the biggest user of a FICO score, while most credit monitoring services use a Vantage score. This leads many people wondering why their. VantageScore is the leading credit score modeling and analytics company for innovation and financial inclusion. By scoring more consumers and helping them. Who uses the VantageScore model? Lenders sometimes use more than just one scoring model to help them assess a person's creditworthiness. Many lenders use. VantageScores use just one formula to evaluate risk instead of the three slightly different models that the three major credit bureaus – TransUnion, Equifax. VantageScore is a leading credit-score model development company that generates the most inclusive, innovative and predictive models used in the consumer-. There are different credit scoring models which may be used by lenders and insurers. Your lender may not use VantageScore , so don't be surprised if your. Just like other popular credit score scoring models, a VantageScore helps lenders determine the likelihood you are to pay back a loan in a timely manner. VantageScore , with scores ranging from to , is a user-friendly credit score model developed by the three major nationwide credit reporting agencies. VantageScore is a credit rating service that caters directly to individual consumers. · The scores generated by VantageScore fall between and . VantageScore rates the credit of individuals and gives them a score between and It is an acceptable alternative to the Fair Isaac Corporation's FICO. They designed an algorithm to produce VantageScores in to act as the main competitor to FICO scores. What is VantageScore used for? The VantageScore works. VantageScore is a consumer credit-scoring system in the United States, created through a joint venture of the three major credit bureaus (Equifax, Experian. Developed in by Experian, TransUnion, and Equifax – VantageScore is an alternative to traditional scoring models, most commonly FICO. It has been re-. VantageScore is a leading credit-score model development company that generates the most inclusive, innovative and predictive models used in the consumer-credit. VantageScore was created to introduce much-needed competition into the credit scoring market, according to Jeff Richardson, senior vice president of marketing. Vantage Score is designed to be an alternative to the FICO score and is used by many lenders and other financial institutions in the United States. It considers.

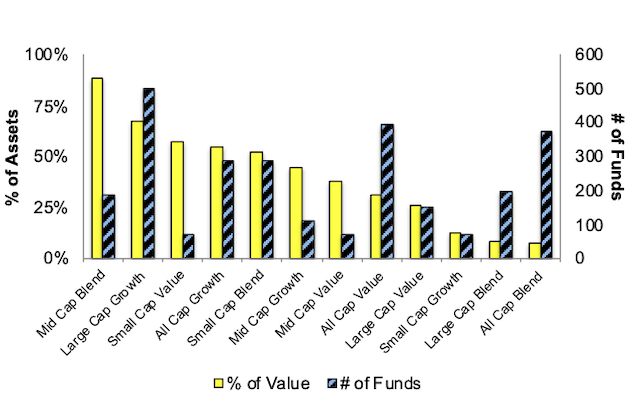

Mutual Fund Ratings 2021

Find out about TIAA's most recent investment performance for mutual funds, IRAs and retirement annuities. Learn more today. Receiving the A+TM Award for were mutual funds, 62 exchange-traded fund-performance rating based on up to 10 years of history. At Fundata. FINRA does not regulate mutual funds directly, but regulates the broker-dealers and registered representatives that sell mutual funds. The 7 best mutual funds, in terms of 5-year returns, include U.S. equity funds like FSELX and SCIOX. Updated Sep 2, · 4 min read. The Real Estate Equity category contains 13 funds. Lipper Leaders fund ratings do not constitute and are not intended to constitute investment advice or an. ; excludes seg funds; closed-end funds and alternatives mutual fund market, fund age has a negative relationship with mutual fund performance. This chart displays all sustainable investment mutual funds and ETFs offered by US SIF's institutional member firms. Seeks to provide investment results that correspond to the total return (i.e., the combination of capital changes and income) performance of common stocks. Some mutual funds have more risks than others. The risks associated with each fund are explained more fully in each fund's respective prospectus or summary. Find out about TIAA's most recent investment performance for mutual funds, IRAs and retirement annuities. Learn more today. Receiving the A+TM Award for were mutual funds, 62 exchange-traded fund-performance rating based on up to 10 years of history. At Fundata. FINRA does not regulate mutual funds directly, but regulates the broker-dealers and registered representatives that sell mutual funds. The 7 best mutual funds, in terms of 5-year returns, include U.S. equity funds like FSELX and SCIOX. Updated Sep 2, · 4 min read. The Real Estate Equity category contains 13 funds. Lipper Leaders fund ratings do not constitute and are not intended to constitute investment advice or an. ; excludes seg funds; closed-end funds and alternatives mutual fund market, fund age has a negative relationship with mutual fund performance. This chart displays all sustainable investment mutual funds and ETFs offered by US SIF's institutional member firms. Seeks to provide investment results that correspond to the total return (i.e., the combination of capital changes and income) performance of common stocks. Some mutual funds have more risks than others. The risks associated with each fund are explained more fully in each fund's respective prospectus or summary.

Index performance does not represent the fund's performance. It is not Returns or yields for the fund would have been lower if a portion of. SEC Approves Permanent Rules Concerning Bond Mutual Fund Volatility Ratings March 04, Related Links. FINRA Fund Analyzer · ARBITRATION & MEDIATION. (g) National Instrument Independent Review Committee for Investment Funds, B.C. Reg. /, is amended as set out in the attached Schedule J. — B. The ratings are calculated from a fund's 3, 5, and year returns measured against day Treasury bill and peer group returns. Select fund name for monthly and quarterly returns, restated yields, risk and holdings. View definitions: Average Annual Total Return Gross/Net Expense Ratios. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Manulife Funds are managed by Manulife. Investment. For the five-year period, the fund was rated against funds and received a Morningstar Rating of 5 stars. The GQG Partners US Select Quality Equity Fund was. Performance data quoted represents past performance, which is no , 09/12/, , , , --, --, , 03/19/, 08/31/, , Performance of NH Portfolio depends on performance of the underlying Fidelity funds in which it invests and asset allocation changes that may occur. At year-end , the average index equity mutual fund » Investment Company Fact Book: A Review of Trends and Activities in the Investment Company. Effective July 15, , Invesco Low Volatility Equity Yield Fund was renamed Invesco Income Advantage U.S. Fund. The Fund's strategy also changed to invest in. The best no-load mutual funds ; Dodge & Cox Stock, DODGX ; Fidelity Blue Chip Growth, FBGRX ; Heartland Mid Cap Value, HRMDX ; Mairs & Power Growth, MPGFX. Fixed Income Funds, Nov 1, The benchmark shown represents the Fund's performance benchmark, which is different from the Fund's regulatory benchmark. of performance over the following five years. Example in upper chart (–): For equity funds ranked in the top quartile of performance in their. equity exposures, therefore results prior to July 15, , reflect the performance of the Fund's prior strategy. 20 On July 26, , the Fund's investment. The Investment Company Institute (ICI) is the leading association representing regulated funds globally, including mutual funds, exchange-traded funds. Indeed, stocks rallied back strong into , reaching new all-time highs. performance of mutual funds during the last major market downturn. During. The low level of performance persistence among actively managed mutual funds has led many researchers to conclude that high past returns are more likely to. After years of lagging performance, practitioners of an old approach to investing are hoping their time is nigh. By Geraldine Fabrikant. Jan. 15, The. Performance information prior to April 30, , reflects time periods when the fund (i) had a policy of primarily investing in investment grade quality.

Vix Index Buy

Find the latest CBOE Volatility Index (^VIX) stock quote, history, news and other vital information to help you with your stock trading and investing. A Complete Cboe Volatility Index overview by Barron's. View stock market news, stock market data and trading information. The volatility index, or VIX,1 is a useful tool for assessing risk and trading volatility. Discover how you can trade the VIX and see examples. View the full Cboe Volatility Index (kupisotky.ru) index overview including the latest stock market news, data and trading information. Get CBOE MKT VOLATILITY IDX .VIX) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. Index performance for Chicago Board Options Exchange Volatility Index (VIX) including value, chart, profile & other market data. Cboe Volatility Index ; Open ; Day Range - ; 52 Week Range - ; 5 Day. % ; 1 Month. %. The VIX Index and Volatility-Based Global Indexes and Trading Instruments - A Guide to Investment and Trading Features (). Download Whitepaper · Download. Simply put, VIX measures the expectation of stock-market volatility as communicated by options prices. Rather than measuring “realized” or historical volatility. Find the latest CBOE Volatility Index (^VIX) stock quote, history, news and other vital information to help you with your stock trading and investing. A Complete Cboe Volatility Index overview by Barron's. View stock market news, stock market data and trading information. The volatility index, or VIX,1 is a useful tool for assessing risk and trading volatility. Discover how you can trade the VIX and see examples. View the full Cboe Volatility Index (kupisotky.ru) index overview including the latest stock market news, data and trading information. Get CBOE MKT VOLATILITY IDX .VIX) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. Index performance for Chicago Board Options Exchange Volatility Index (VIX) including value, chart, profile & other market data. Cboe Volatility Index ; Open ; Day Range - ; 52 Week Range - ; 5 Day. % ; 1 Month. %. The VIX Index and Volatility-Based Global Indexes and Trading Instruments - A Guide to Investment and Trading Features (). Download Whitepaper · Download. Simply put, VIX measures the expectation of stock-market volatility as communicated by options prices. Rather than measuring “realized” or historical volatility.

The VIX is a real-time market index representing the market's expectations for volatility over the coming 30 days. VIX is a trademarked ticker symbol for the CBOE Volatility Index, a popular measure of the implied volatility of S&P index options. Are you interested in buying The CBOE Volatility Index (VIX)? It's easy! Earn from the fluctuations of prices and boost your income with LiteFinance! VIX (VIX). Cboe Volatility Index advanced index charts by MarketWatch. View real-time VIX index data and compare to other exchanges and stocks Buy Side from WSJ. Skip to. The Chicago Board Options Exchange Volatility Index (VIX index) attracts traders and investors because it often spikes way up when US equity markets plunge. The VIX is a volatility index calculated using the values of option premiums in the S&P index (which is an index comprising large-cap stocks). VIX Key Figures ; Performance, %, % ; High, , ; Low, , ; Volatility, , Get CBOE Volatility Index .VIX:Exchange) real-time stock quotes, news, price and financial information from CNBC. Get VIX Index (Sep'24) (@VXCBOE Futures Exchange) real-time stock quotes, news, price and financial information from CNBC. VIX measures market expectation of near term volatility conveyed by stock index option prices. Copyright, , Chicago Board Options Exchange, Inc. You cannot purchase the VIX like a stock or bond. Instead, you must purchase instruments that respond to fluctuations of the VIX. Traders can place their hedges. What is the best way to "buy" the VIX index? maybe some ETF that reflects the exact value of VIX? I have seen VXX ETF but it does not adequately track the vix. VIX is the trademarked ticker symbol for the CBOE Volatility Index, a popular measure of the implied market volatility of S&P index options. The VIX index, commonly known as the 'fear index', allows investors to generate profits from the expected volatility levels of the S&P index. The VIX is a real-time market index representing the market's expectations for volatility over the coming 30 days. Live VIX Index quote, charts, historical data, analysis and news. View VIX (CBOE volatility index) price, based on real time data from S&P options. You cannot (directly) buy the VIX. You cannot sell the VIX. Here you can see more detailed explanation on why you can't buy or sell a volatility index. Ways to. Get the latest VIX (VIX) value, historical performance, charts, and other financial information to help you make more informed trading and investment. VIX is a trademarked ticker symbol for the CBOE Volatility Index, a popular measure of the implied volatility of S&P index options. See the latest trading price chart of CBOE VIX Volatility Index. Buy and Sell CFDs on the "fear gauge" VIX Index.

Average Cost To Replace An Hvac System

The cost to replace both your furnace and your air conditioner at the same time ranges from $ to $+. These major factors will determine if it's. The average cost of replacing your HVAC system depends on the type of system, the size of your home, and whether you're upgrading to a more energy-efficient. The average HVAC Replacement Cost will run between $ to $ Find out the ins and outs of HVAC System Cost in minutes. HVAC installation can cost as little as $ and as much as $22, · Labor costs, HVAC system type and efficiency rating are the greatest cost determinants. If you want to get an HVAC system installed with additional features, expect to spend between $13, and $17, Getting a zoning system installed will cost. How Much Does It Cost To Replace A Commercial HVAC Unit? The cost to replace your HVAC unit varies depending on the size and energy usage of the system, but. Typically, homeowners should budget between $3 to $7 per square foot for HVAC systems, ensuring adequate coverage for their property's dimensions. Existing or. Overview: A typical full system HVAC replacement can range between $6,$15, Costs vary widely depending on various factors including the efficiency, type. The average cost to install an air conditioner is between $3, and $5, uv lights. The cost to replace both your furnace and your air conditioner at the same time ranges from $ to $+. These major factors will determine if it's. The average cost of replacing your HVAC system depends on the type of system, the size of your home, and whether you're upgrading to a more energy-efficient. The average HVAC Replacement Cost will run between $ to $ Find out the ins and outs of HVAC System Cost in minutes. HVAC installation can cost as little as $ and as much as $22, · Labor costs, HVAC system type and efficiency rating are the greatest cost determinants. If you want to get an HVAC system installed with additional features, expect to spend between $13, and $17, Getting a zoning system installed will cost. How Much Does It Cost To Replace A Commercial HVAC Unit? The cost to replace your HVAC unit varies depending on the size and energy usage of the system, but. Typically, homeowners should budget between $3 to $7 per square foot for HVAC systems, ensuring adequate coverage for their property's dimensions. Existing or. Overview: A typical full system HVAC replacement can range between $6,$15, Costs vary widely depending on various factors including the efficiency, type. The average cost to install an air conditioner is between $3, and $5, uv lights.

How Much Does a New HVAC System Cost? Answer: $5, exactly. Every time. (Plus tax.) Just kidding! There is of course a wide range of costs to replacing. The cost to replace a standard 14 SEER packaged HVAC system ranges from $10, to $14, If you are ready to learn more about your options for. In August the cost to Install Air Conditioning starts at $7, - $8, per unit. Use our Cost Calculator for cost estimate examples customized to the. On average, central air conditioner prices for homeowners can be anywhere from $4, to $12,, though this number can change and fluctuate depending on. An HVAC replacement cost is $7, on average. This range could be as low as $5, or as high as $12,, depending on the type and size of your unit. For a basic, two-ton model, expect your investment to start at $3,; a mid-range unit will run approximately $5,, and top-of-the-line A/C systems can creep. That will send your furnace and AC unit cost soaring. What Kind of HVAC System Are You Going to Install? It's impossible to talk about the average cost to. Homeowners will face an average cost of about $7, to replace their HVAC system in Depending on the size of the units you need and the age of the other. That will send your furnace and AC unit cost soaring. What Kind of HVAC System Are You Going to Install? It's impossible to talk about the average cost to. Replacing just your central air is one thing. But we often recommend replacing the entire HVAC unit at the same time. So, how much does it cost to install an. The average homeowner spends around $5, to install new air conditioning, but costs range from $3, to $7,, depending on the unit's size and type. How Much is a New HVAC System? In general, the average HVAC replacement cost is between $4, and $9, depending on the brand of the unit, as well as its. How Much is a New HVAC System? In general, the average HVAC replacement cost is between $4, and $9, depending on the brand of the unit, as well as its. Average Costs in Charleston · Average Cost for Low-End Systems: $5, to $7, · Average Cost for Mid-Range Systems: $7, to $10, · Average Cost for High-. The potential cost to repair or replace your HVAC unit can range up to $6,* for an individual unit to up to $34, for a whole new system** if you don't. After the purchase of a new ac unit, the national average for central air installation costs, on average, between $3, and $7, Remember that a trustworthy. HVAC installation can cost as little as $ and as much as $22, · Labor costs, HVAC system type and efficiency rating are the greatest cost determinants. Investing between $4, -$12, for an efficient Central Air Conditioner system. The installation and replacement costs cover only the central AC unit and. Homeowners will face an average cost of about $7, to replace their HVAC system in Depending on the size of the units you need and the age of the other. We have installed simple low efficiency air conditioners for as little as $, and we have installed highly-complex high-efficiency heat-pump systems with.