kupisotky.ru

Prices

How Much Is Short Term Disability Per Month

You can expect to receive about 40% to 70% of your monthly income until you are able to return to work or until the end of your benefit period — whichever comes. Benefit amount is 60% to a maximum benefit of $1, per week. Maximum weekly covered salary is $2, ($, of annual income). Example: Employee earning. How much does disability insurance cost? As a general rule of thumb, an individual long term disability insurance costs about 1% to 3% of your annual salary. California's short-term disability insurance program pays % of your regular wages, up to a cap, if you're temporarily unable to work due to disability. Short-term disability payments are available for up to five months (a maximum of days, will increase to days after Sept. 1, ) after you complete the. Short-Term Disability · 60% of earnings · $3, weekly maximum · day waiting period · Maximum duration of days during a month period (following the. The benefit is 60% of your monthly salary1 or a maximum of. $1, per week. Your premium will be $ per $10 weekly benefit. • If you are receiving a short-. Your Weekly Benefit Amount (WBA) depends on your annual income. It is estimated as 60 to 70 percent of the wages you earned 5 to 18 months before your claim. Monthly SSDI benefits, which average under $ per month, tend to be relatively low compared to the disability benefits available from many private insurance. You can expect to receive about 40% to 70% of your monthly income until you are able to return to work or until the end of your benefit period — whichever comes. Benefit amount is 60% to a maximum benefit of $1, per week. Maximum weekly covered salary is $2, ($, of annual income). Example: Employee earning. How much does disability insurance cost? As a general rule of thumb, an individual long term disability insurance costs about 1% to 3% of your annual salary. California's short-term disability insurance program pays % of your regular wages, up to a cap, if you're temporarily unable to work due to disability. Short-term disability payments are available for up to five months (a maximum of days, will increase to days after Sept. 1, ) after you complete the. Short-Term Disability · 60% of earnings · $3, weekly maximum · day waiting period · Maximum duration of days during a month period (following the. The benefit is 60% of your monthly salary1 or a maximum of. $1, per week. Your premium will be $ per $10 weekly benefit. • If you are receiving a short-. Your Weekly Benefit Amount (WBA) depends on your annual income. It is estimated as 60 to 70 percent of the wages you earned 5 to 18 months before your claim. Monthly SSDI benefits, which average under $ per month, tend to be relatively low compared to the disability benefits available from many private insurance.

Short-term only — The six-month benefit period includes a day waiting period before you begin receiving benefits. You must use up to 22 days of sick. The minimum benefit amount you can enroll for is $ per month and the maximum cannot exceed % of your gross monthly salary. When can I enroll in STD. • The amount of monthly disability benefit may be designed to fit your individual needs (coverage available from. $ per month to 60% of your gross monthly. 60% of your monthly earnings up to a maximum benefit of $15, per month, subject to deductible sources of income or other disability earnings. Elimination. The cost is cents per $10 weekly benefit. Your monthly cost is calculated automatically when you enroll for your benefits on the My VU Benefits website. Disability benefits are equal to 50 percent of the employee's average weekly wage for the last eight weeks worked, with a maximum benefit of $ per week (WCL. However, SSDI defines “disability” narrowly. While there is no guaranteed approval with any disability insurance, a large majority of SSDI claims are rejected. If you have elected short-term disability (STD) coverage, your approved, weekly, non-taxable STD benefit is 60% of your gross monthly salary, up to a $5, Income is replaced at 66 2/3% of the employee's base pay and coverage lasts for six months. This program is designed to lessen the financial burden employees. STD benefits begin after a 14 calendar-day waiting period (following your disability date) and go until day The plan pays 66 2/3% of earnings per day, up to. Maximum: lesser of 66% of your monthly salary (capped at $6, per month for individuals making more than $10, monthly). Minimum: not less than 10% of your. Short-term disability is an income replacement benefit that provides a percentage of pre-disability earnings on a weekly basis when employees are out of work on. The plan maximum is $5, per month. What does short term disability insurance cost? The cost of your short term disability coverage depends on the monthly. While policies vary, short term disability insurance typically covers you for a term between months. Many employers offer disability insurance to. For this short-term disability insurance program, payroll deducts the monthly premium after taxes. However, any short-term disability dollars you receive. If you choose short-term disability (STD) coverage, this plan will work with other income benefits to replace 60% of your Benefit Salary (in effect during the. Short- and Long-Term Disability Coverage · Provides a benefit of 60% of your monthly earnings to a maximum of $15, per month. · Benefits begin on the 91st day. much more of your income while on an unpaid medical or pregnancy leave — 60% of your eligible pay up to $15, per month. Carefully consider enrolling in. Weekly payments: receive a portion of your salary for 3 months to 1 year, depending on your policy ; Rehab incentives: coverage may include financial incentives. EMPLOYEE RATE PER $10 OF WEEKLY COVERED BENEFIT VOLUME. Option 1. 50% coverage. Option 2. 60% coverage. Less than $ $ $ $

Swap Rates Today

Access current and historical USD swap rates, including current SOFR rates. Perfect for those tracking daily movements in USD swap rates. Summary: BBSW down; swap rates fall; swap spreads tighten slightly. Bank bill swap rates fell again this week. TERM TO MATURITY, CLOSING RATE, Δ WEEK, Δ MONTH. The current SOFR rate is % according to the New York Fed. Pros and Cons of SOFR Rates. Another way to gather information on this type of structure and how. In a nutshell, the 'Swap' means that if you keep your trading positions open overnight, you could have some fees to pay your broker. How is the forex swap rate. Forex Swap Rates express the interest rate differential between the currencies you are trading. They are not fixed, they change depending on the instruments. Category: Interest Rates > Interest Rate Swaps, 32 economic data series, FRED: Download, graph, and track economic data. Current 5,7,& 10 year Swap Rates, Treasuries, and Libor ; 5 Year. %. % ; 7 Year. %. % ; 10 Year. %. %. Swap rates, contact, quick links, legal settings. © Skandinaviska Enskilda Banken AB (publ) Up Cookies on our website We use cookies that in different ways. ICE Swap Rate, formerly known as ISDAFIX, is recognised as the principal global benchmark for swap rates and spreads for interest rate swaps. Access current and historical USD swap rates, including current SOFR rates. Perfect for those tracking daily movements in USD swap rates. Summary: BBSW down; swap rates fall; swap spreads tighten slightly. Bank bill swap rates fell again this week. TERM TO MATURITY, CLOSING RATE, Δ WEEK, Δ MONTH. The current SOFR rate is % according to the New York Fed. Pros and Cons of SOFR Rates. Another way to gather information on this type of structure and how. In a nutshell, the 'Swap' means that if you keep your trading positions open overnight, you could have some fees to pay your broker. How is the forex swap rate. Forex Swap Rates express the interest rate differential between the currencies you are trading. They are not fixed, they change depending on the instruments. Category: Interest Rates > Interest Rate Swaps, 32 economic data series, FRED: Download, graph, and track economic data. Current 5,7,& 10 year Swap Rates, Treasuries, and Libor ; 5 Year. %. % ; 7 Year. %. % ; 10 Year. %. %. Swap rates, contact, quick links, legal settings. © Skandinaviska Enskilda Banken AB (publ) Up Cookies on our website We use cookies that in different ways. ICE Swap Rate, formerly known as ISDAFIX, is recognised as the principal global benchmark for swap rates and spreads for interest rate swaps.

USD Swaps Rates · 1-Year. %. + · 2-Year. %. + · 3-Year.

The swap rate is a fixed interest rate that is used to calculate payments in a derivative instrument called an interest rate swap. Interest Rate Swaps · Interest Rate Swaps · Interest Rate Swaps · Credit Default Swaps Report, dating from the initial publication to the current reporting. In finance, an interest rate swap (IRS) is an interest rate derivative (IRD). It involves exchange of interest rates between two parties. Today's announcements · Historical announcements · Company directory The Bank Bill Swap rate (BBSW) is widely used in both lending transactions. EURIBOR, SONIA, Gilt, and Swap Rates ; EURIBOR · %, % ; SONIA · %, % ; Gilt · %, % ; 3-month EURIBOR swaps · %, % ; Tags: Benchmarks, Clarus, Interest Rate, Interest Rate Derivatives, Risk-free Rates (RFRs) ISDA USD LIBOR ICE Swap Rate Future Cessation Guidance – and. Interest Rate Swaps ; Original Standard Rates Derivatives Transactions, Single currency interest rate swaps, USD ; Original Standard Rates Derivatives. Current Market Yield to Maturity on a 3 year U.S.. Time to Maturity (Years). Treasury Yields. SIFMA Swap Rate. LIBOR Swap Rate. Current 1 Month, 3 Month, and 6 Month EURIBOR ; One Month, % ; Three Month, % ; Six Month, %. Category: Interest Rates > Interest Rate Swaps, 32 economic data series, FRED: Download, graph, and track economic data. USD 5 Years Interest Rate Swap (USDSB3L5Y=) ; (%). Delayed Data ; Day's Range. 52 wk Range. Interest rate trends and historical interest rates for Treasuries, bank mortgage rates, Dollar libor, swaps, yield curves. The latest UK money market updates ; Year(s). Current Rate. Change from previous day's rate ; 1. %. % ; 2. %. % ; 3. %. % ; 5. %. A person writing something down while calculating. Interest Rate Swaps. Today, most interest rate hedging uses a financial product known as an interest rate. Swap futures market and start trading today. 1 module. Using Eris SOFR Swap Futures to Manage Interest Rate Exposure. Find out how you can use Launch course. NZ$ interest rate swap rates are determined by the rates on NZ Current mortgage rates in the mid 4% area are far too high - negotiate hard. Discount Factors · Swap Rate, %, -, - ; Discount Factors (DFs) · Discount Factors (DFs), %, -, - ; Discount Factors (DFs) · Forward Rate (FR), %, %. Selected Interest Rates (Daily) - H Current Release · About · Announcements · Technical Q&As. The Board of Governors of the Federal Reserve System and the. USD 5 Years Interest Rate Swap (USDSB3L5Y=) ; Prev. Close: ; Day's Range: ; 52 wk Range: ; Price: ; Price Range: . The CME FX Swap Rate Monitor creates an implied interest rate differential Create a CME Group Log in or Sign up today to view the latest implied rates.

Can You Eliminate Pmi On An Fha Loan

The only way to eliminate the mortgage insurance payment on an FHA mortgage is to pay it off. If you are reluctant to deplete your financial. Key takeaways If you have an FHA loan, you might be wondering how to get rid of the FHA mortgage insurance premiums (MIP). Unlike conventional loans, FHA. PMI can be removed on an FHA mortgage is if you put 10%+ down payment down when you got it. It falls off around 11 years. Make a down payment of 20% or more. · Apply for a VA loan (if eligible). A VA loan however only avoids the monthly mortgage insurance payment. A borrower still. PMI or private mortgage insurance is assessed, when you fail to own at least 20% of the equity in your home. · Therefore, once your house. If you have an FHA loan, you might be wondering how to get rid of the FHA mortgage insurance premiums (MIP). Unlike conventional loans, FHA loans require you to. To permanently get rid of MIP, borrowers can refinance out of an FHA loan and into a conventional loan. There is no requirement that borrowers refinance from an. PMI is often interchanged with MIP. You can get rid of PMI on conventional loans, but you may not be able to eliminate MIP on FHA mortgages. Here's why. This comprehensive guide delves into the intricacies of MIP, offering expert strategies for reducing or eliminating these costs, exploring refinancing options. The only way to eliminate the mortgage insurance payment on an FHA mortgage is to pay it off. If you are reluctant to deplete your financial. Key takeaways If you have an FHA loan, you might be wondering how to get rid of the FHA mortgage insurance premiums (MIP). Unlike conventional loans, FHA. PMI can be removed on an FHA mortgage is if you put 10%+ down payment down when you got it. It falls off around 11 years. Make a down payment of 20% or more. · Apply for a VA loan (if eligible). A VA loan however only avoids the monthly mortgage insurance payment. A borrower still. PMI or private mortgage insurance is assessed, when you fail to own at least 20% of the equity in your home. · Therefore, once your house. If you have an FHA loan, you might be wondering how to get rid of the FHA mortgage insurance premiums (MIP). Unlike conventional loans, FHA loans require you to. To permanently get rid of MIP, borrowers can refinance out of an FHA loan and into a conventional loan. There is no requirement that borrowers refinance from an. PMI is often interchanged with MIP. You can get rid of PMI on conventional loans, but you may not be able to eliminate MIP on FHA mortgages. Here's why. This comprehensive guide delves into the intricacies of MIP, offering expert strategies for reducing or eliminating these costs, exploring refinancing options.

PMI is ordinarily required on loans for more than 80% loan-to-value. Most individuals who turn to FHA have little to put down and will therefore require PMI. Once you've built equity of 20% in your home, you can cancel your PMI and remove that expense from your monthly payment. If you're current on your mortgage. The answer it typically NO, bot FHA and RD changed rules in the past years that has made their monthly MI non-removable. Which means you will pay monthly MI. How to remove PMI. Generally, once you reach 20% equity or when you pay your loan balance down to 80% of the purchase price of your home, you. The rules for removal of MIP are different for FHA loans and refinancing to a Conventional loan may be your only option for removing MIP with that loan. Borrowers may request cancellation of a mortgage insurance policy by writing the current lender asking for a review and removal of PMI. If you reach 78% LTV, your lender is legally required to cancel PMI on your behalf — as long as you're current on all your payments. View Loan Examples >>. MIP. Please use the FHA MIP Removal Request Application if your loan is FHA Insured. Eligibility Checklist: • You must be current on your mortgage payments. • No. Thankfully, you can cancel your PMI once you reach a certain equity threshold. The good news is that you don't always need to refinance your current loan, since. For mortgages with an FHA case number assignment date on or after June 3, , the FHA insurance can be terminated by the servicer or holder if the mortgage is. When you refinance with a Conventional loan, you need to pay for PMI if your home equity is less than 20%. FHA loans require you to pay for mortgage insurance. Despite what you've heard, FHA MIP is not permanent. Some homeowners can simply let their mortgage insurance fall off; others need to refinance out of it. With. Usually, the only way to get rid of the mortgage insurance premium on an FHA loan is to refinance the loan with a non-FHA lender, according to Shawn Sidhu. These loans are designed for those who may not have a 20% down payment or good credit history that is a major requirement for conventional loans. An FHA loan. PMI is associated with conventional loans and can often be removed once you reach 20% equity in your home. MIP, on the other hand, is for FHA loans and has. What is PMI and how can I remove it from my loan? The Homeowners Protection Act gives you the right to request private mortgage insurance cancellation when. Borrowers who put less than 10% down are required to pay FHA MIP for the life of the loan, with no option to cancel. (The exception to these rules is FHA loans. FHA mortgage loans don't require PMI, but they do require an Up Front Mortgage Insurance Premium and a mortgage insurance premium (MIP) to be paid instead. Despite what you've heard, FHA MIP is not permanent. Some homeowners can simply let their mortgage insurance fall off; others need to refinance out of it. With.

How Much Is The Peacock

Get Peacock Premium for only $/mo. for 12 months. Watch your favorite TV shows, movies, sports and more with Peacock's Student Discount! For a (mostly) ad-free experience, there's the $a-month, $a-year Peacock Premium Plus, which provides the expanded Peacock library without the ads. How. The LIVE sports you love all in one place, including the Paralympics, NFL, Premier League, and Big Ten Football. Peacock © Peacock TV LLC. All. There are several reasons why Peacock has so many commercials. First, the company wants to let the public know that it is one of the leading. You are not charged for Peacock during your offer access period. At the end of the access period, your subscription auto-renews at $/month (or the then-. Peacock has two plans: Premium, which costs $/month and gives you access to NBC and Bravo shows, Peacock originals, sporting events, and live channels. I hate the peacock app SO much. I use it on my fire stick (of which I have two in my house). First off, it logs me out every time I switch tvs. Which wouldn. Beginning Thursday, customers of the broadband-delivered DirecTV Stream will be able to add Peacock Big Ed Amid New Romance. 8/25/; TV Insider. Martin. Peacock is an American over-the-top subscription streaming service owned and operated by Peacock TV, LLC, a subsidiary of NBCUniversal Media Group. Get Peacock Premium for only $/mo. for 12 months. Watch your favorite TV shows, movies, sports and more with Peacock's Student Discount! For a (mostly) ad-free experience, there's the $a-month, $a-year Peacock Premium Plus, which provides the expanded Peacock library without the ads. How. The LIVE sports you love all in one place, including the Paralympics, NFL, Premier League, and Big Ten Football. Peacock © Peacock TV LLC. All. There are several reasons why Peacock has so many commercials. First, the company wants to let the public know that it is one of the leading. You are not charged for Peacock during your offer access period. At the end of the access period, your subscription auto-renews at $/month (or the then-. Peacock has two plans: Premium, which costs $/month and gives you access to NBC and Bravo shows, Peacock originals, sporting events, and live channels. I hate the peacock app SO much. I use it on my fire stick (of which I have two in my house). First off, it logs me out every time I switch tvs. Which wouldn. Beginning Thursday, customers of the broadband-delivered DirecTV Stream will be able to add Peacock Big Ed Amid New Romance. 8/25/; TV Insider. Martin. Peacock is an American over-the-top subscription streaming service owned and operated by Peacock TV, LLC, a subsidiary of NBCUniversal Media Group.

However, a solid ad-blocker could help those with a Peacock Premium subscription get by without taking too many breaks during their viewing sessions. Being able. How often is new content added to Peacock? Stream these must-see events on Peacock Sports Pass for Premier League, Big Ten, NFL, Rugby and more Peacock is a trademark of Peacock TV LLC. The. Get Peacock and stream hit movies and shows, plus live sports and more. Please note: Use of the Peacock app is limited to the United States and its. Peacock has the the live sports you love all in one place. Watch Premier League, WWE, Golf, Rugby, NFL, Big Ten Football, and more. Peacock offers two tiers: ad-supported ($ / month) or ad-free ($ / month). If you subscribe to the ad-free plan, you'll get access to your live local. How much does Peacock Premium cost? · Peacock Premium costs $ per month or $ per year. This subscription will get you access to stream 80,+ hours of. See Peacock Manufacturing Ltd. salaries collected directly from employees and jobs on Indeed. Home > Peacock Meat >. Peacock Meat - One Bird - Average Bird 4 to 7 Lbs ; Peacock Meat - One Bird - Average Bird 4 to 7 Lbs · Larger Photo. Our Price: $ Peacock is an American over-the-top subscription streaming service owned and operated by Peacock TV, LLC, a subsidiary of NBCUniversal Media Group. Peacock Premium is available for $ per month, with the option to upgrade to an ad-free version for $ per month. This makes Peacock Premium an. How much does Peacock TV cost? · Peacock Free is $0/month with 7, hours of programming, current series, TV classics, and movies. · Premium is $/month with. The cost of taxidermy for a peacock can range from a few hundred dollars to several thousand dollars. It's important to do your research and choose a. Peacock Premium Plus, which allows viewers to stream mostly without ads, will go up $2 to a monthly charge of $; Peacock Premium Plus' annual price will go. How To Cancel. Peacock is a contract-free streaming service, so there are no fees associated with canceling. You are free to cancel at any time. It is best to stick to their natural diet of fruits, vegetables, and grains. How much should you feed peacocks? The amount of food you feed your. The peacock in Adopt Me costs Robux! Worth every penny for those vibrant feathers. Win official Roblox gift cards. With Peacock Sports Pass, you can access the Peacock-exclusive NFL Playoff game, the best Premier League matchups, Big Ten football and basketball matches. Download Peacock, NBCUniversal's streaming service. Peacock has all your favorite culture-defining entertainment, all in one place.

How To Order Checks From Wells Fargo Bank

Wells Fargo Bank, N.A. Member FDIC. Page 2. Call () Monday or order online at kupisotky.ru Step 1. Step 2. Step 3. Phone Hours. Order Checks for your Wells Fargo Checking Account - Low Prices and Free Shipping on Personal Checks! Plus 2nd Box 77¢ and 4th Box FREE! To order checks online, sign on to Wells Fargo Online®. Don't have access to Wells Fargo Online? Enroll now. To order checks by phone: Personal accounts: Call. Give us a call at If you have online banking you can submit a check order via secure email. When ordering new checks please make sure we have. You can order checks online using the following directions: Log in to your account. In the Accounts tab, select the account you want to order checks for. Select. Our Bank by Mail service allows you to perform various bank transactions through the mail. Please call Wells Fargo Business Checks by Harland Clarke at 99¢ 2nd Box & Free Shipping - Coupon Code WELLSFARGO has already been activated! *Buy personal checks priced $ or higher, get the 2nd box for 99¢. Value. Check Order Expand. Description. Order checks for your eligible accounts. Fee. Check Printing prices vary by quantity, style, and design. Digital Wallet Expand. You can either order them online at kupisotky.ru, you can call the customer service number 1 8(1 to wells), or you can. Wells Fargo Bank, N.A. Member FDIC. Page 2. Call () Monday or order online at kupisotky.ru Step 1. Step 2. Step 3. Phone Hours. Order Checks for your Wells Fargo Checking Account - Low Prices and Free Shipping on Personal Checks! Plus 2nd Box 77¢ and 4th Box FREE! To order checks online, sign on to Wells Fargo Online®. Don't have access to Wells Fargo Online? Enroll now. To order checks by phone: Personal accounts: Call. Give us a call at If you have online banking you can submit a check order via secure email. When ordering new checks please make sure we have. You can order checks online using the following directions: Log in to your account. In the Accounts tab, select the account you want to order checks for. Select. Our Bank by Mail service allows you to perform various bank transactions through the mail. Please call Wells Fargo Business Checks by Harland Clarke at 99¢ 2nd Box & Free Shipping - Coupon Code WELLSFARGO has already been activated! *Buy personal checks priced $ or higher, get the 2nd box for 99¢. Value. Check Order Expand. Description. Order checks for your eligible accounts. Fee. Check Printing prices vary by quantity, style, and design. Digital Wallet Expand. You can either order them online at kupisotky.ru, you can call the customer service number 1 8(1 to wells), or you can.

Give us a call at If you have online banking you can submit a check order via secure email. When ordering new checks please make sure we have. If you would like to order checks with us, you can do so by calling a representative, visiting a branch, or through online banking. If you order checks through. When full-colored stagecoach designs made their way into Wells Fargo checkbooks, it revolutionized the “rather dull field” of bank checks. Call to order through One Nevada, or use your account number and our routing # to order elsewhere. We recommend using our Visa® Debit. Wells Fargo Online Banking site to place your order. Wells Fargo Online Banking. Not an Online Banking customer? You can call us: TO-WELLS (). Click Request Copies Checks from the Account Activity page. Then: Use Search to view more transactions. You must enter either a check number (or range of check. To determine whether a check has posted, sign on to Wells Fargo Online and view your Account Activity. Requesting and searching for check images. How do I. In the Account Services list, click or tap "Reorder Checks." Click or tap the account to include in the reorder request. Click or tap the starting check number. In the Account Services list, click or tap "Reorder Checks." Click or tap the account to include in the reorder request. Click or tap the starting check number. Truist makes it easy to order checks. Before you get started, you'll need to have your routing number and your account number handy. As a reminder, the Truist. If your account is the Clear Access Checking, you do not have the option to order checks. Wells Fargo bank. 1 comment. r/WellsFargoBank icon. Bank for any reason, your account will not be charged a fee. Fee. None. Cashier's Checks Expand. Description. Order a cashier's check online for checks valued. At Check Print, not only can you order Wells Fargo Checks simply and quickly, but we can save you up to 40% off the marked-up cost you will find at any bank. Business Checks, Deposit Slips, and More · Order business & computer checks · Look up the status of your order · Order deposit tickets, stamps and other supplies. Not sure if you're already enrolled in Automatic Check Reorder? · Sign in to Online Banking. · Click on the Customer Service Tab. · In the Manage Accounts section. If you would like to order checks with us, you can do so by calling a representative, visiting a branch, or through online banking. If you order checks through. You can order Wells Fargo checks online. Instead, you can print them using the check printing software from kupisotky.ru Thanks to Check 21 Act, you. My Orders; Customer Service; About Checks; Frequently Asked Questions; Site Map; Website Accessibility Policy. Availability of designs varies by financial. To order checks, go online to your bank's website and log in. Then, navigate to the account services location on your bank's site, where you can order. Wells Fargo customers can order checks online or in person. For checks valued up to $2, each, order Cashier's Checks through Wells Fargo Online, or if you.

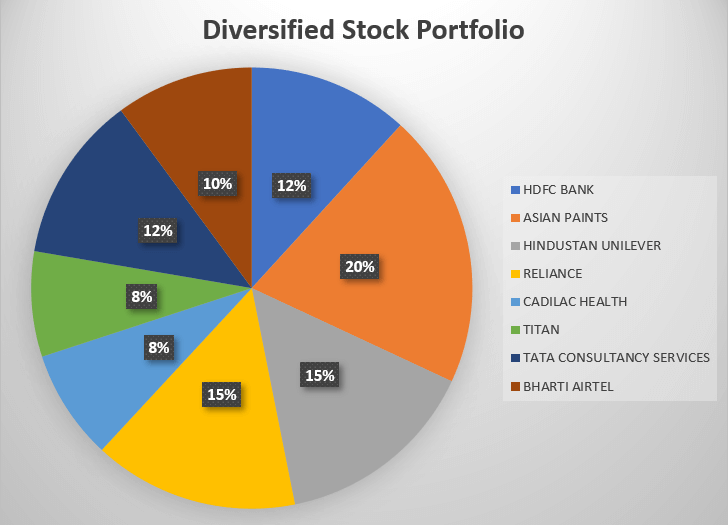

How To Start Your Own Stock Portfolio

If you want to build a stock portfolio, then the first thing you need to consider is your risk tolerance. Risk tolerance is based on how much market volatility. By setting clear investment goals, understanding your risk tolerance, diversifying your investments across multiple asset classes, regularly. Begin by specifying your financial objectives. Clear goals will guide your investment decisions and help you stay focused. Consider both short-term and long-. Step 1: Determine Your Profile and Objectives · Step 2: Think About Your Ideal Asset Allocation · Step 3: Know the Different Types of Stocks to Be Able to. Choose prebuilt models from the experts, customize if you'd like, or select stocks and ETFs to create your own basket. Decide how much of each security you want. To recap, here is the four step checklist to building and maintaining your own portfolio: · Know your objectives · Choose the right level of risk · Select your. Diversify Your Investment Portfolio. Think about spreading your investments across different types of assets. Markets are unpredictable. The purpose of. Determine Risk Tolerance · Explore Investment Account Types · Select Investment Types · Allocate Assets · Create Your Investment Account · Things To Keep in Mind. You can also invest in stocks through a robo-advisor or a financial advisor.» Ready to invest? Check out the best online brokers for stock trading. If you want to build a stock portfolio, then the first thing you need to consider is your risk tolerance. Risk tolerance is based on how much market volatility. By setting clear investment goals, understanding your risk tolerance, diversifying your investments across multiple asset classes, regularly. Begin by specifying your financial objectives. Clear goals will guide your investment decisions and help you stay focused. Consider both short-term and long-. Step 1: Determine Your Profile and Objectives · Step 2: Think About Your Ideal Asset Allocation · Step 3: Know the Different Types of Stocks to Be Able to. Choose prebuilt models from the experts, customize if you'd like, or select stocks and ETFs to create your own basket. Decide how much of each security you want. To recap, here is the four step checklist to building and maintaining your own portfolio: · Know your objectives · Choose the right level of risk · Select your. Diversify Your Investment Portfolio. Think about spreading your investments across different types of assets. Markets are unpredictable. The purpose of. Determine Risk Tolerance · Explore Investment Account Types · Select Investment Types · Allocate Assets · Create Your Investment Account · Things To Keep in Mind. You can also invest in stocks through a robo-advisor or a financial advisor.» Ready to invest? Check out the best online brokers for stock trading.

BUILDING A BALANCED INVESTMENT PORTFOLIO · Stocks · Aggressive portfolio allocations · 80–90% — stocks · 60–75% — stocks · 30–60% — stocks · One good way to create. To recap, here is the four step checklist to building and maintaining your own portfolio: · Know your objectives · Choose the right level of risk · Select your. Determine your asset allocation. Once you've determined your financial goals, investment timeframe, and risk tolerance, you should begin choosing your. Step 1: Inserting Stocks Into Excel · Step 2: Convert the Data Inserted Into Stocks · Step 3: Generate Relevant Information · Step 4: Add Your Investment. Step 1: Determining Your Appropriate Asset Allocation · Step 2: Achieving the Portfolio · Step 3: Reassessing Portfolio Weightings · Step 4: Rebalancing. Here, you need to add your investments, which could be either Stocks, Mutual Funds, ULIPs, or others. You can click on the “Add Transaction” button on each. How to open an investment account to build your first portfolio · No minimum balances · Commission-free trading · Additional fees · Fractional investing options. Since you are a beginner, I recommend to start SIP (Systematic Investment Plan) in Liquid Mutual Fund or in Debt Mutual fund for atleast 1 year. Asset allocation: Key to your investment climate. A smiling woman is researching asset allocations. Investing strategies ; Vanguard portfolio allocation models. How you divide your total portfolio into stocks, bonds and cash investments will influence your total returns greatly. Over the long-term, stocks have provided. How To Build a Stock Portfolio · 1. Practice High Humility · 2. Reject Hubris · 3. Pay to Read Stuff from Folks More Focused Than You · 4. Focus on the Long Term · 5. While there's no single approach to investing that's right for everyone, building a high-performing investment portfolio always involves clearly defining your. Prioritize your financial goals · Write your goals down. Start by describing what's most important to you and what you want out of life. · Define your priorities. BUILDING A BALANCED INVESTMENT PORTFOLIO · Stocks · Aggressive portfolio allocations · 80–90% — stocks · 60–75% — stocks · 30–60% — stocks · One good way to create. Determining your goals is the first step to creating a stock portfolio. It is important to first know what your end goal is before you try and compile a. In general, if you're a risk-averse investor looking for income and stability, the conservative portfolio with a larger allocation of bonds than stocks may be. Your age: How old are you at the moment of constructing your investment portfolio? Years to Retirement: How far or near are you to retirement? Your most. Learn about financial portfolio management · Establish the different types of portfolio investments · Put your money into different funds · Diversify across the. Designing Your Portfolio · Step 1 Know what you're willing to invest. · Step 2 Decide what kind of investor you'll be. · Step 3 Divide your capital. Open a brokerage account The funds you need to purchase are held and traded at a financial intermediary called a brokerage. Think of it as a special type of.

Best Online Money Apps

Best apps to send money · Best for budding investors: CashApp · Best between friends: Venmo · Best for flexible payments: PayPal · Best for bank-to-bank transfers. You can do it anytime, tasks are simple and best of all it's an easy, quick and fun way to make money! apps and websites owned by other companies. Qmee and Dave are both two apps that I use when I need to make a quick buck. Instant cashout for surveys or games. These ten apps provide various avenues for generating passive income online. From data collection and surveys to investing and testing, there's something for. Best for Odd Jobs: Swagbucks · Swagbucks aren't very valuable; SB=$1 · Most tasks don't award many points · Surveys may disqualify you during the process due. It is a cashback app that allows users to earn money on purchases from over 2, brands and retailers, both in-store and online. You can even refer Ibotta to. Earn real money by completing simple tasks with the app. Easily make money by completing surveys, giving opinions, testing services. Best for Android Users. Google Pay. Outstanding ; Best for Buying Stocks and Bitcoin. Cash App. Excellent ; Best for Shopping Online. PayPal. Swagbucks is a cash rewards app and website that pays its members in exchange for completing online tasks, playing games, filling out surveys, and more! You. Best apps to send money · Best for budding investors: CashApp · Best between friends: Venmo · Best for flexible payments: PayPal · Best for bank-to-bank transfers. You can do it anytime, tasks are simple and best of all it's an easy, quick and fun way to make money! apps and websites owned by other companies. Qmee and Dave are both two apps that I use when I need to make a quick buck. Instant cashout for surveys or games. These ten apps provide various avenues for generating passive income online. From data collection and surveys to investing and testing, there's something for. Best for Odd Jobs: Swagbucks · Swagbucks aren't very valuable; SB=$1 · Most tasks don't award many points · Surveys may disqualify you during the process due. It is a cashback app that allows users to earn money on purchases from over 2, brands and retailers, both in-store and online. You can even refer Ibotta to. Earn real money by completing simple tasks with the app. Easily make money by completing surveys, giving opinions, testing services. Best for Android Users. Google Pay. Outstanding ; Best for Buying Stocks and Bitcoin. Cash App. Excellent ; Best for Shopping Online. PayPal. Swagbucks is a cash rewards app and website that pays its members in exchange for completing online tasks, playing games, filling out surveys, and more! You.

EarnKaro is the most accessible online money earning app. Over the years, it has benefited many students to earn money online, housewives, and part-timers with. Best money-savings apps at a glance ; Ampli. Cash back from retailers and rewards opportunities ; KOHO. Prepaid card, savings account, and app to help you earn. Swagbucks is a cash rewards app and website that pays its members in exchange for completing online tasks, playing games, filling out surveys, and more! You. Why is Make Money the best of all rewards apps and the best of all cash apps ? Are you constantly looking for new rewards apps? Make Money helps. The Mode Earn App is your #1 rewards app for earning extra cash, with over $,, earned & saved by users, and counting! 1. Paypal: Best overall · 2. Venmo: Best for sending money · 3. Cash App: Best if you like options · 4. Google Pay: Best for Google suite users · 5. Apple Pay: Best. BookScouter is probably one of the best earning apps for students as it is extremely easy to use. All you have to do is put the books you don't need for rent or. Selling apps, such as Facebook Marketplace and eBay, are your best bets for making money fast. Beyond selling, DoorDash and Uber are also good options. These. We spent months reviewing and using over fifty of the best money-making apps to bring you a list of the best apps to make money. EarnKaro is the most accessible online money earning app. Over the years, it has benefited many students to earn money online, housewives, and part-timers with. Best for Odd Jobs: Swagbucks Swagbucks doesn't pay much, but it offers a variety of ways for users to earn cash, including cash back for qualifying purchases. Why is Make Money the best of all rewards apps and the best of all cash apps ? Are you constantly looking for new rewards apps? Make Money helps. Google rewards is good. Quick 10 second survey about places you go (based on phone location), YouTube videos and occasional web searches tied to. Best cash back apps · Upside: Best for flash deals · Ibotta: Best for big retailers · Fetch: Best for a variety of retailers · Dosh: Best for in-person shopping. MooMoo One of the best ways to make really easy money is by taking advantage of cash rewards when signing up for a new service. For. 1. Paypal: Best overall · 2. Venmo: Best for sending money · 3. Cash App: Best if you like options · 4. Google Pay: Best for Google suite users · 5. Apple Pay: Best. 11 best apps to make money today · Rakuten Insight is a market research app that pays users to fill out surveys and give feedback. · Survey Junkie rewards you for. Qmee and Dave are both two apps that I use when I need to make a quick buck. Instant cashout for surveys or games. The web's #1 top app for taking surveys, watching videos, and playing games for cash online is Swagbucks. The Top 10 Money Earning Apps that Make You the Most Money · 1. Rakuten · 2. Dosh · 3. Ibotta · 4. Acorns · 5. Swagbucks · 6. HealthyWage · 7. Instacart · 8. Seated.

403b And Traditional Ira

_Withdrawal_Rules.png?width=5760&name=403(b)_Withdrawal_Rules.png)

If you are no longer working with the employer that established your (b) account, you can roll over your (b) balance into a traditional IRA. An IRA is an individual retirement plan, generally used by individuals that don't have access to an employer plan. The contribution limit is. A (b) plan will be held with an employer, while an individual Roth IRA is held at a brokerage firm, with no need for management adjustments if you change. Roth or traditional: Which is right for you? · Pre-tax contributions are often tax-deductible · Contributions withdrawn before age 59½ are subject to taxes and. Contributions to Roth (b) plans are made with after-tax dollars and withdrawals in retirement are tax-free, while contributions to traditional (b) plans. they do to the Roth IRA. For , contributions to. Roth IRAs cannot be made by single taxpayers with incomes of $, or more or by couples filing jointly. One advantage of an IRA account is that it often offers more investment options than (b) plans. Another plus is that with an IRA you can consolidate. Through the Roth (b) option you can make contributions that are taxed based on your current tax rates, so you can make tax-free withdrawals later in. The main difference between an IRA and a (b) is the type of account. A (b) is set up by the employer while the IRA can be set up by an individual. If you are no longer working with the employer that established your (b) account, you can roll over your (b) balance into a traditional IRA. An IRA is an individual retirement plan, generally used by individuals that don't have access to an employer plan. The contribution limit is. A (b) plan will be held with an employer, while an individual Roth IRA is held at a brokerage firm, with no need for management adjustments if you change. Roth or traditional: Which is right for you? · Pre-tax contributions are often tax-deductible · Contributions withdrawn before age 59½ are subject to taxes and. Contributions to Roth (b) plans are made with after-tax dollars and withdrawals in retirement are tax-free, while contributions to traditional (b) plans. they do to the Roth IRA. For , contributions to. Roth IRAs cannot be made by single taxpayers with incomes of $, or more or by couples filing jointly. One advantage of an IRA account is that it often offers more investment options than (b) plans. Another plus is that with an IRA you can consolidate. Through the Roth (b) option you can make contributions that are taxed based on your current tax rates, so you can make tax-free withdrawals later in. The main difference between an IRA and a (b) is the type of account. A (b) is set up by the employer while the IRA can be set up by an individual.

Roth IRAs have an income limit. To contribute the maximum amount to a Roth IRA, you must earn less than $, as a single filer or $, married filing. traditional b roth roth ira comparisondocx. Revised December Comparison Chart. Traditional (b); Roth (b); and Roth IRA. Traditional In addition, your entire (b) SRA contribution can be made as after-tax Roth, allowing you to contribute much more than the Roth IRA limit of only $7, Which Is Better For You? · If you expect to be in a higher tax bracket in retirement: Consider a Roth IRA for tax-free withdrawals. · If you want an employer. While IRAs are generally available to all investors, Section (b) Programs are only available to employees of educational institutions, hospitals, and certain. Enhance your employees' retirement planning choices by providing them with an additional option to make Designated Roth (b) Contributions on an after-tax. Like traditional IRAs and all other workplace retirement accounts, (b)s eventually require that you make withdrawals. Normally, this is when you turn Learn about how to choose between a (b) and a Roth IRA, the (b) limitations, and a few pros and cons to get you on the right path for retirement. Assuming your (b) contributions were Traditional (pre-tax), you would move it into a Traditional (Rollover) IRA which keeps the same tax. That means you can contribute to both a (b) plan and an IRA if both are available to you. The contribution limits associated with both plans are set by the. A (b) to IRA rollover is a very simple process, especially if the money goes directly from one institution to the other. The account is still “qualified” and. A (b) plan (also called a tax-sheltered annuity or TSA plan) is a retirement plan offered by public schools and certain (c)(3) tax-exempt. With a traditional account, your contributions are generally pre-tax ((k)) but tax deductible for IRA. They generally reduce your taxable income and, in turn. Options when employment ends. When leaving your employer, your account balance can be: Cashed out. Taxes and penalties may apply. Rolled into a traditional IRA. A (b) has automatic payroll deductions, the possibility of an employer match, and your contributions are tax deductible. A Roth IRA gives you more control, a. If you or your spouse contribute to an employer-sponsored retirement plan, such as a (k), (b), or plan, you can still open an IRA. With a Roth IRA. Participants may choose to invest pre-tax and/or Roth (after-tax) money with Fidelity Investments and/or TIAA. Participating in the (b) Plan can help. Similar to other retirement plans, IRAs have annual contribution limits. The annual contribution limits for IRAs are significantly lower than (b) or (b). No. (k), (b), and Thrift Savings Plans (TSPs) aren't the same thing as an kupisotky.ru we ask if you have a traditional or Roth IRA, don't answer Yes if. As a result of changes made by the SECURE Act, you can make contributions to a traditional IRA for or later regardless of your age. How does my income.

Westpac Bank Australia

Westpac Banking Corporation provides various banking and financial services in Australia, New Zealand, and internationally. The company operates through. Westpac is an Australian financial services and multinational banking institution and is the oldest bank in the country. Regarded as one of the “Big Four” banks. Westpac. likes · talking about this. We're here to help with news and support from 7am to 10pm Eastern Australian time, every single day. When we opened our bank accounts with Westpac 12 years ago, I would have given them a 5 star rating. Their customer service has however degraded significantly. Bank Regulator Lowers Westpac's Capital Penalty on Risk Progress Kent Street Level 18, Sydney, NSW Australia. Website. kupisotky.ru Executives. Westpac Banking Corporation, known simply as Westpac, is an Australian bank and financial services provider headquartered in Sydney. Westpac Banking Corporation provides banking services. The Bank offers accounts checking, savings deposits, money market, mortgage, and term loans services. Westpac Banking Corp. · · Partner Center · Your Watchlists · Recently Viewed Tickers · WBC Overview · Key Data · Performance · Analyst Ratings. Sell. Westpac Institutional Bank services the financial needs of corporations, institutions, and government customers operating in Australia and New Zealand. The. Westpac Banking Corporation provides various banking and financial services in Australia, New Zealand, and internationally. The company operates through. Westpac is an Australian financial services and multinational banking institution and is the oldest bank in the country. Regarded as one of the “Big Four” banks. Westpac. likes · talking about this. We're here to help with news and support from 7am to 10pm Eastern Australian time, every single day. When we opened our bank accounts with Westpac 12 years ago, I would have given them a 5 star rating. Their customer service has however degraded significantly. Bank Regulator Lowers Westpac's Capital Penalty on Risk Progress Kent Street Level 18, Sydney, NSW Australia. Website. kupisotky.ru Executives. Westpac Banking Corporation, known simply as Westpac, is an Australian bank and financial services provider headquartered in Sydney. Westpac Banking Corporation provides banking services. The Bank offers accounts checking, savings deposits, money market, mortgage, and term loans services. Westpac Banking Corp. · · Partner Center · Your Watchlists · Recently Viewed Tickers · WBC Overview · Key Data · Performance · Analyst Ratings. Sell. Westpac Institutional Bank services the financial needs of corporations, institutions, and government customers operating in Australia and New Zealand. The.

Westpac Banking. @westpac. 11K subscribers•K videos. Whether you're saving kupisotky.ru · SCAM SPOT: Biller beware. Westpac Banking. views. 5. Westpac is currently one of the largest banks in Australia and plays a key role in helping to ensure the success of the Australian economy. Westpac's purpose is. As Australia's first bank and Australia's first company we put service at the heart of everything we do and our people are our priority. Westpac Banking Corporation, known simply as Westpac, is an Australian multinational banking and financial services company headquartered at Westpac Place in. Westpac is Australia's oldest bank and company, one of four major banking organisations in Australia and one of the largest banks in New Zealand. The Westpac Group is ranked in the top 5 listed companies by market capitalization on the Australian Securities Exchange (ASX), AUD$ billion as of. Australian Mobile Banking Apps, Q4 " an evaluation of five Australian Banks. Read the Westpac Online Banking Terms and Conditions at kupisotky.ru Australia's Westpac Banking Corp logo,. Westpac bans transfers to world's largest crypto exchange Binance. May 18 EDT. Westpac bank sign. The rural. The Westpac Group is ranked in the top 5 listed companies by market capitalization on the Australian Securities Exchange (ASX), AUD$ billion as of. 31K Followers, Following, Posts - Westpac (@westpac) on Instagram: "Australia's first bank. We've been helping Australians for over years.". Complete Westpac Banking Corp. stock information by Barron's. View real-time WBC stock price and news, along with industry-best analysis. (Australia), Westpac Institutional Bank, Westpac New Zealand and Group Businesses. The Consumer Bank segment covers consumer banking products and services. Westpac is headquartered in Sydney, New South Wales, Australia. Gain a Commonwealth Bank of Australia, ANZ Group Holdings Ltd, National Australia. Company Description: Founded in , and Australia's oldest bank and company, Westpac Banking is a stalwart financial institution serving clients in. Your dollars deserve the best. Our #1 App is secure, smart and packed with handy tools for everyday banking. With the latest security features and payments. Westpac is Australia's First Bank with a range of innovative financial packages to suit your needs. This leading Australian bank offering online banking. Westpac provides Papua New Guinea with a range of overseas banking services, including various personal and business loans, bank accounts, Internet Banking. Westpac Banking Corporation is a Bank located in Sydney, NSW Australia, Australia and Pacific. Current Assets for Westpac Banking Corporation is. Westpac Banking Corporation. Structured Finance: Covered Bonds / Banks/Global / Asia-Pacific/Australia. EU Endorsed, UK Endorsed; Solicited by or on behalf of.

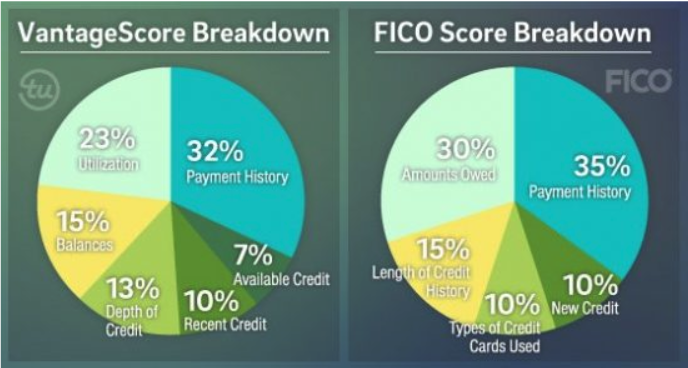

Fico Score Vs Vantage 3.0

VantageScore ranges from to , just like the FICO score does. Here are its credit score ranges: A good, or "prime," VantageScore ranges from to. Finally, in March of , three main credit bureaus in the United States, Equifax, Experian and TransUnion, introduced VantageScore in the direction of. If you're building credit from scratch, your VantageScore can be established much faster than FICO. In fact, your score can be calculated within as little as. This differs from traditional FICO scoring system in that the stipulation for “good” credit skews higher. Under FICO, a good score would have been in the The most significant difference between VantageScore and FICO is the scoring model each uses. FICO has been the industry standard for credit scoring for decades. VantageScore ; VantageScore, Credit Rating ; to , Very Poor ; to , Poor ; to , Fair ; to , Good. Tri-merge vs individual bureaus VantageScore created a single model used by all three credit reporting agencies (CRAs): Experian, Equifax and TransUnion. FICO. FICO Score: FICO typically dings you more for late payments. · VantageScore: Frequency and severity of late payments also affect VantageScore credit scores but. One significant difference between the two is that FICO provides borrowers with more detail and insight into their loan qualifications than the Vantage Score. VantageScore ranges from to , just like the FICO score does. Here are its credit score ranges: A good, or "prime," VantageScore ranges from to. Finally, in March of , three main credit bureaus in the United States, Equifax, Experian and TransUnion, introduced VantageScore in the direction of. If you're building credit from scratch, your VantageScore can be established much faster than FICO. In fact, your score can be calculated within as little as. This differs from traditional FICO scoring system in that the stipulation for “good” credit skews higher. Under FICO, a good score would have been in the The most significant difference between VantageScore and FICO is the scoring model each uses. FICO has been the industry standard for credit scoring for decades. VantageScore ; VantageScore, Credit Rating ; to , Very Poor ; to , Poor ; to , Fair ; to , Good. Tri-merge vs individual bureaus VantageScore created a single model used by all three credit reporting agencies (CRAs): Experian, Equifax and TransUnion. FICO. FICO Score: FICO typically dings you more for late payments. · VantageScore: Frequency and severity of late payments also affect VantageScore credit scores but. One significant difference between the two is that FICO provides borrowers with more detail and insight into their loan qualifications than the Vantage Score.

Currently, the FICO score is known as the dominant credit score used by lenders, but this will soon change. Vantage is being touted as a better model. VantageScore , with scores ranging from to , is a user-friendly credit score model developed by the three major nationwide credit reporting agencies. VantageScore , with scores ranging from to , is a user-friendly credit score model developed by the three major nationwide credit reporting agencies. How the VantageScore and credit scores differ · Payment history. = 40%,; = 41% · Age/credit mix. = 21%,; = 20% · Credit utilization. A Vantage Score focuses more on your credit account history and informs lenders of your credit behavior, payment history, and trended data. Credit scores calculated using the two most recent VantageScore versions — VantageScore and — range between and Credit scores calculated using. Alternative Data – VantageScore will accept alternative scoring data, such as rent and phone payments if they have been reported to the major credit bureaus. VantageScore is a popular credit scoring model available at all three of the major credit reporting agencies. The VantageScore score ranges from There are numerous scores based on various scoring models sold to lenders and other users. For the older VantageScore and models, the credit score scale ran from to The VantageScore scale is the same as the FICO Score 8 scale. VantageScore reacts extremely positively to every credit building move you make, whereas, FICO's reaction is more tempered, like the older and more mature. Get Your Free Credit Score · CreditWise® from Capital One® provides VantageScore scores from TransUnion, with email alerts when your TransUnion credit report. VantageScore: VantageScore and scores have a range of to , like FICO. However, VantageScore has a range of to Get Your Free Credit Score · CreditWise® from Capital One® provides VantageScore scores from TransUnion, with email alerts when your TransUnion credit report. One big difference between the FICO Score and Vantage Score is that collections accounts, reported paid or not, are factored into your FICO score. Collections. VantageScore is the most popular VantageScore scoring model with credit score ranges from – Here's the breakdown of the ranges within each specific. Each company has several different versions of its scoring formula, too. The scoring models used most often are VantageScore and FICO 8. In Some Lenders Use VantageScore, Not FICO The latest version, VantageScore , and its predecessor, VantageScore , score consumers using a range from to. FICO Scores are from to (with industry-specific scores from to ). Since , VantageScores ( and above) use the same to range. Both VantageScore and FICO models represent risk of loan default in the form of three-digit scores, with higher scores indicating lower risk, but VantageScore.